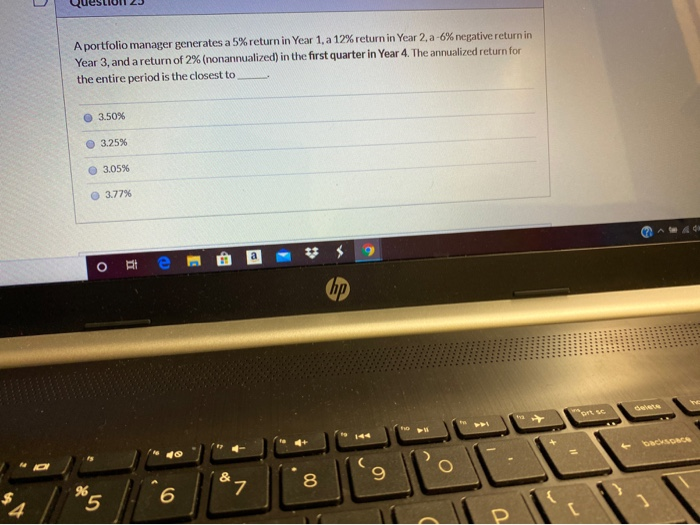

A Portfolio Manager Generates A 5 Return In Year 1 - A portfolio manager generates a 5% return in. Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year. To calculate this, apply the geometric mean to evaluate the total return over the entire period. There’s just one step to solve this. Adrian, a portfolio manager, generates a return of 14% when the benchmark returns. 37.a portfolio manager generates a 5% return in 2008, a 12% return in 2009, a negative 6% return.

Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year. There’s just one step to solve this. A portfolio manager generates a 5% return in. 37.a portfolio manager generates a 5% return in 2008, a 12% return in 2009, a negative 6% return. Adrian, a portfolio manager, generates a return of 14% when the benchmark returns. To calculate this, apply the geometric mean to evaluate the total return over the entire period.

To calculate this, apply the geometric mean to evaluate the total return over the entire period. Adrian, a portfolio manager, generates a return of 14% when the benchmark returns. There’s just one step to solve this. Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year. 37.a portfolio manager generates a 5% return in 2008, a 12% return in 2009, a negative 6% return. A portfolio manager generates a 5% return in.

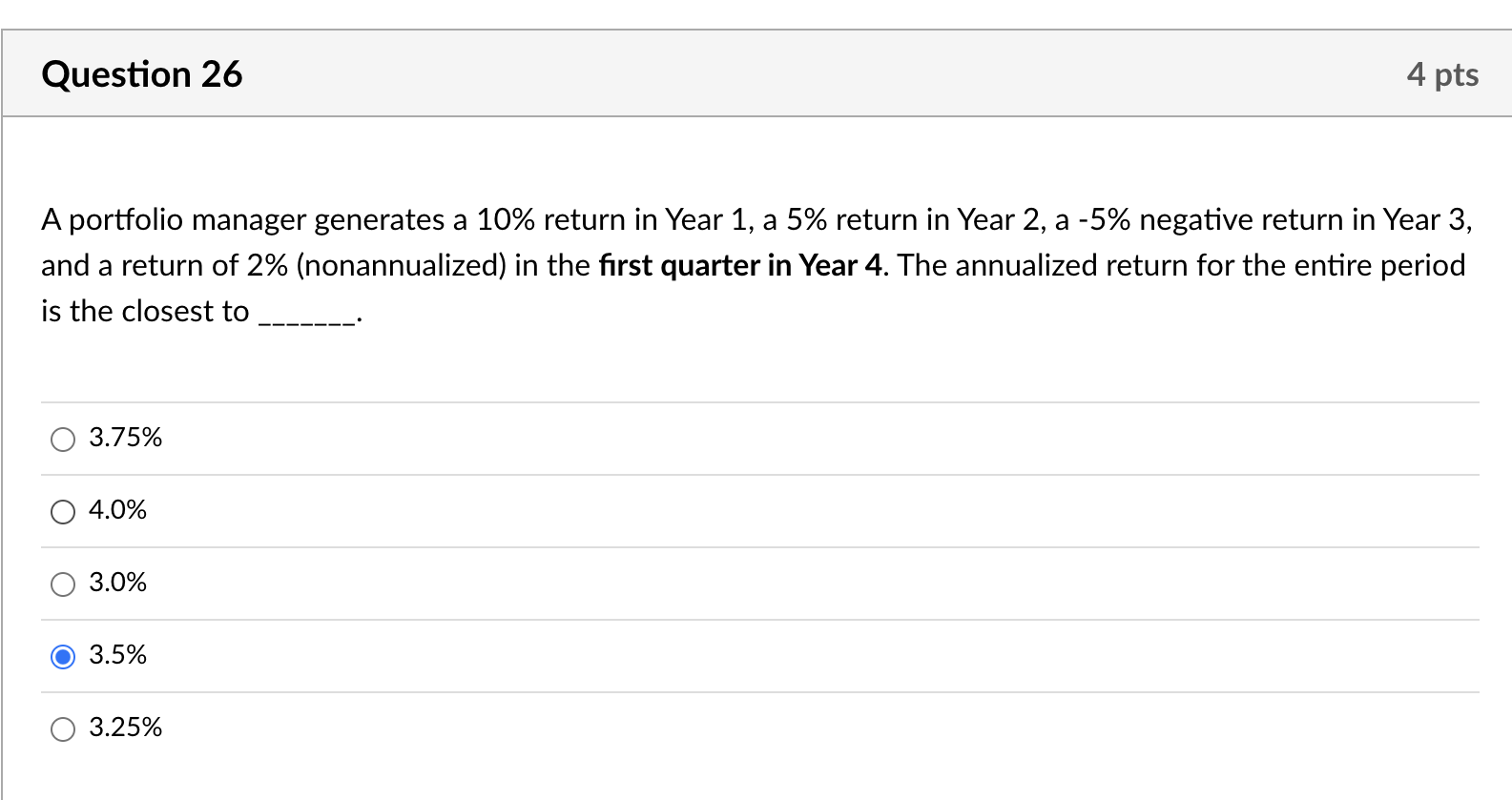

Solved A portfolio manager generates a 5 return in Year 1,

To calculate this, apply the geometric mean to evaluate the total return over the entire period. A portfolio manager generates a 5% return in. Adrian, a portfolio manager, generates a return of 14% when the benchmark returns. Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year. 37.a portfolio manager generates a.

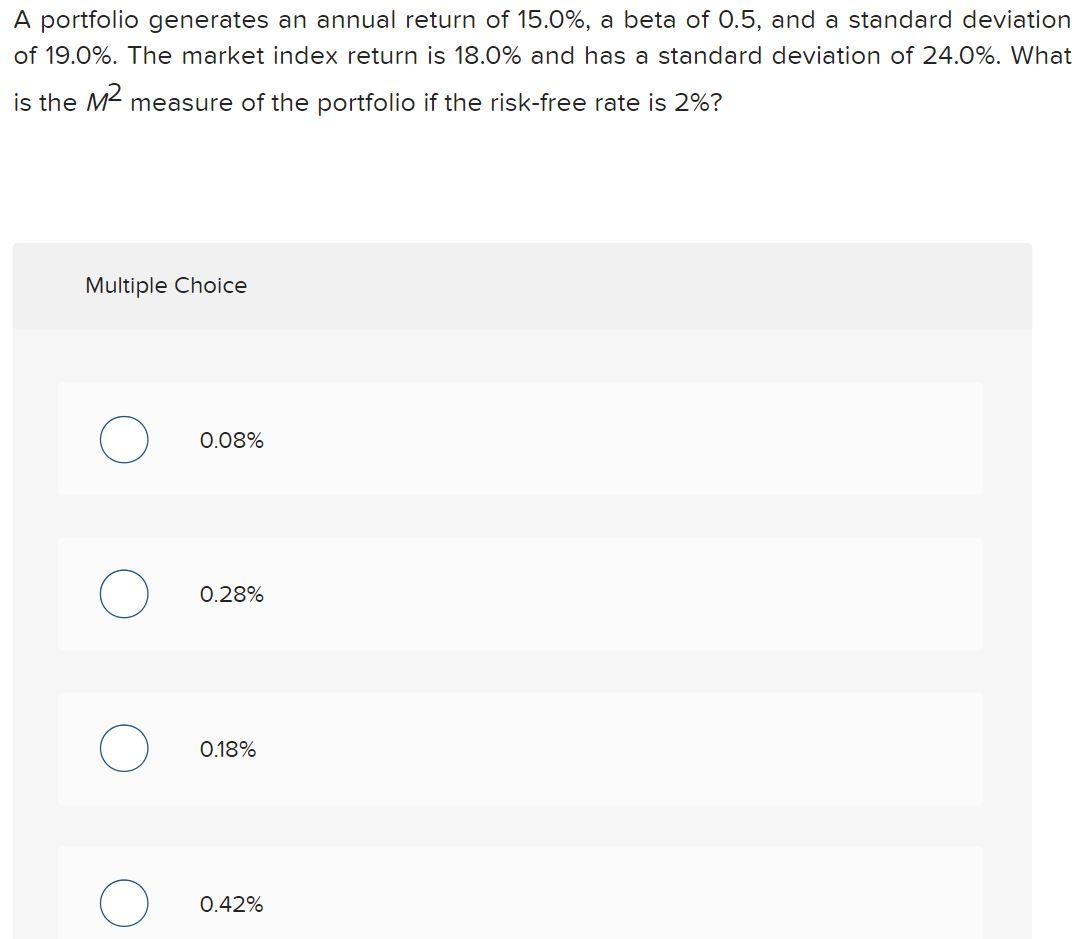

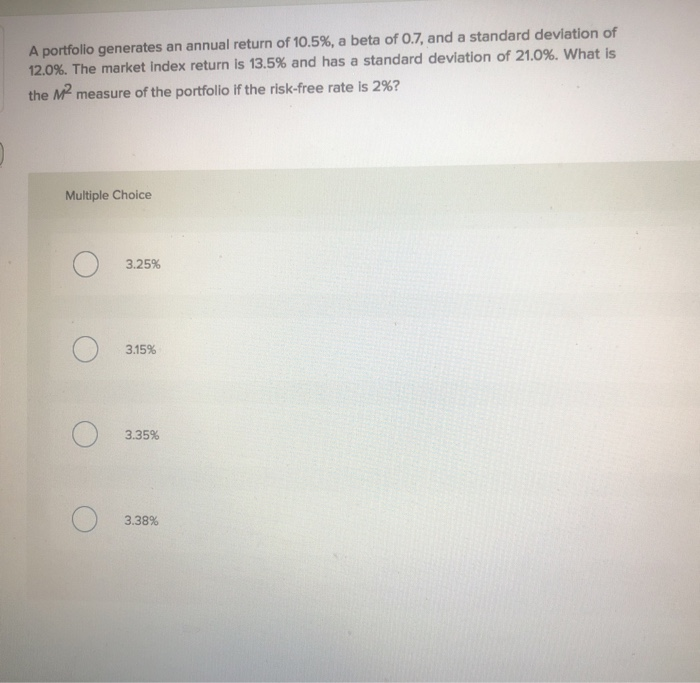

Solved A portfolio generates an annual return of 15.0, a

Adrian, a portfolio manager, generates a return of 14% when the benchmark returns. Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year. A portfolio manager generates a 5% return in. 37.a portfolio manager generates a 5% return in 2008, a 12% return in 2009, a negative 6% return. To calculate this,.

How to Calculate Annualized Portfolio Return 8 Steps

Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year. There’s just one step to solve this. A portfolio manager generates a 5% return in. Adrian, a portfolio manager, generates a return of 14% when the benchmark returns. To calculate this, apply the geometric mean to evaluate the total return over the.

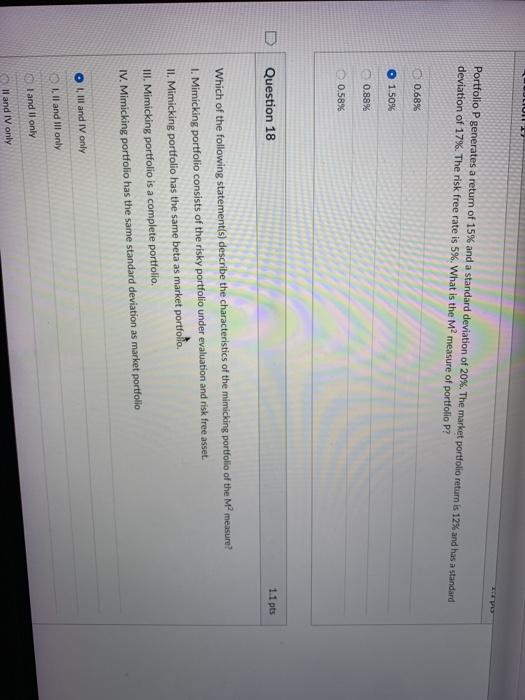

Solved Portfolio P generates a return of 15 and a standard

37.a portfolio manager generates a 5% return in 2008, a 12% return in 2009, a negative 6% return. To calculate this, apply the geometric mean to evaluate the total return over the entire period. Adrian, a portfolio manager, generates a return of 14% when the benchmark returns. Portfolio manager generates 6% return in year 1, 0% return in year 2,.

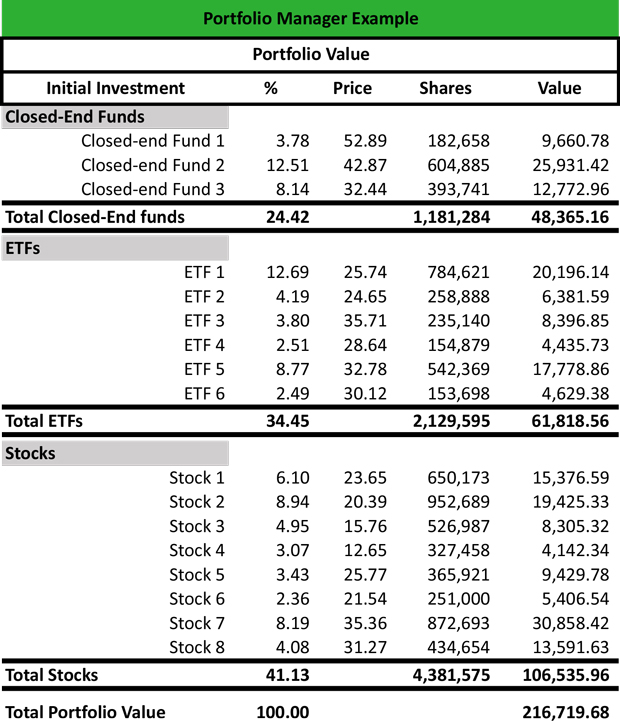

What is a Portfolio Manager? Definition Meaning Example

To calculate this, apply the geometric mean to evaluate the total return over the entire period. There’s just one step to solve this. Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year. Adrian, a portfolio manager, generates a return of 14% when the benchmark returns. A portfolio manager generates a 5%.

Solved A portfolio manager generates a 10 return in Year 1,

To calculate this, apply the geometric mean to evaluate the total return over the entire period. Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year. There’s just one step to solve this. Adrian, a portfolio manager, generates a return of 14% when the benchmark returns. 37.a portfolio manager generates a 5%.

A portfolio generates a total return of 15 . The tax rates on interest

A portfolio manager generates a 5% return in. There’s just one step to solve this. To calculate this, apply the geometric mean to evaluate the total return over the entire period. Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year. Adrian, a portfolio manager, generates a return of 14% when the.

Solved A portfolio generates an annual return of 10.5, a

Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year. Adrian, a portfolio manager, generates a return of 14% when the benchmark returns. There’s just one step to solve this. A portfolio manager generates a 5% return in. To calculate this, apply the geometric mean to evaluate the total return over the.

How to Calculate Annualized Portfolio Return 8 Steps wikiHow

37.a portfolio manager generates a 5% return in 2008, a 12% return in 2009, a negative 6% return. A portfolio manager generates a 5% return in. Adrian, a portfolio manager, generates a return of 14% when the benchmark returns. There’s just one step to solve this. Portfolio manager generates 6% return in year 1, 0% return in year 2, negative.

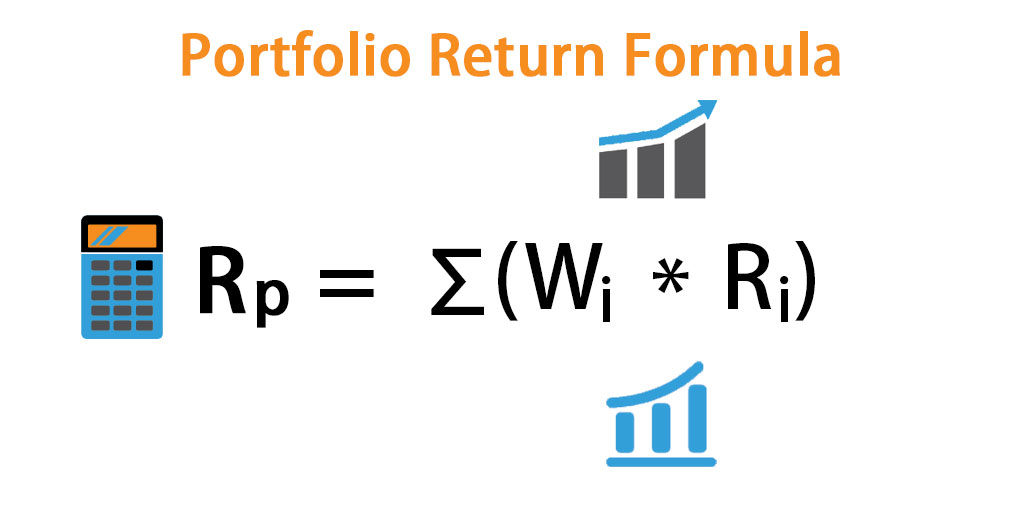

Portfolio Return Formula Calculator (Examples With Excel Template)

Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year. There’s just one step to solve this. 37.a portfolio manager generates a 5% return in 2008, a 12% return in 2009, a negative 6% return. To calculate this, apply the geometric mean to evaluate the total return over the entire period. Adrian,.

To Calculate This, Apply The Geometric Mean To Evaluate The Total Return Over The Entire Period.

There’s just one step to solve this. 37.a portfolio manager generates a 5% return in 2008, a 12% return in 2009, a negative 6% return. Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year. Adrian, a portfolio manager, generates a return of 14% when the benchmark returns.