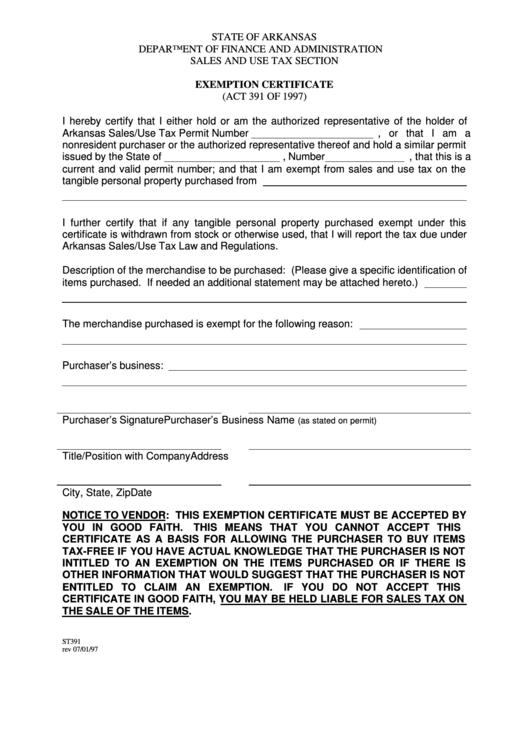

Arkansas Tax Exemption Form - Provide the id number to claim exemption from sales tax that is required by the taxing state. The wages exempt from arkansas income tax will be the total of the amounts shown as exempt. File this form with your employer. Otherwise, your employer must withhold state income tax from. However, if the seller fraudulently fails to collect the sales tax, solicits a purchaser to participate.

However, if the seller fraudulently fails to collect the sales tax, solicits a purchaser to participate. The wages exempt from arkansas income tax will be the total of the amounts shown as exempt. Otherwise, your employer must withhold state income tax from. Provide the id number to claim exemption from sales tax that is required by the taxing state. File this form with your employer.

The wages exempt from arkansas income tax will be the total of the amounts shown as exempt. However, if the seller fraudulently fails to collect the sales tax, solicits a purchaser to participate. Otherwise, your employer must withhold state income tax from. Provide the id number to claim exemption from sales tax that is required by the taxing state. File this form with your employer.

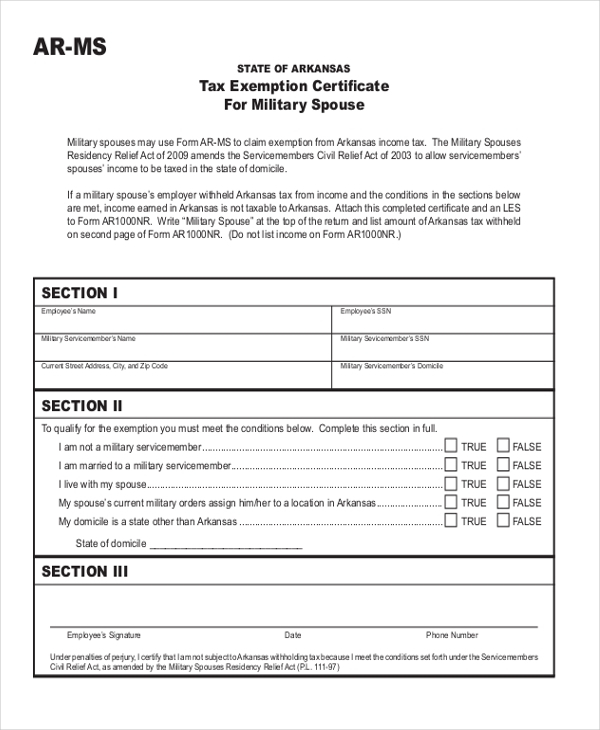

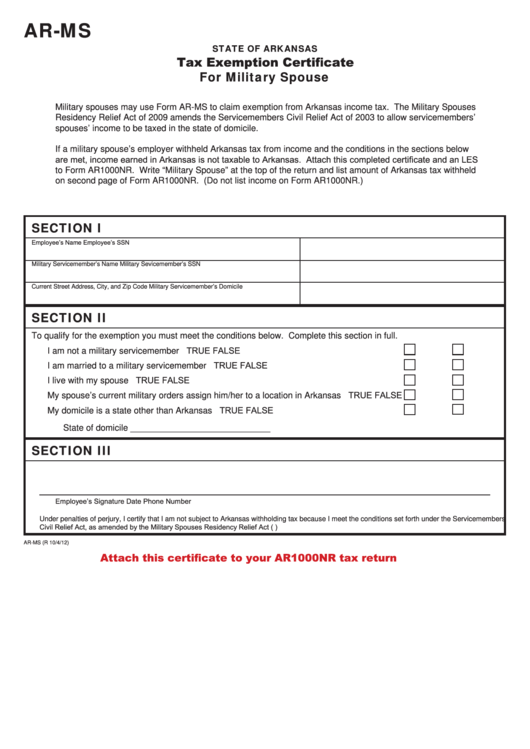

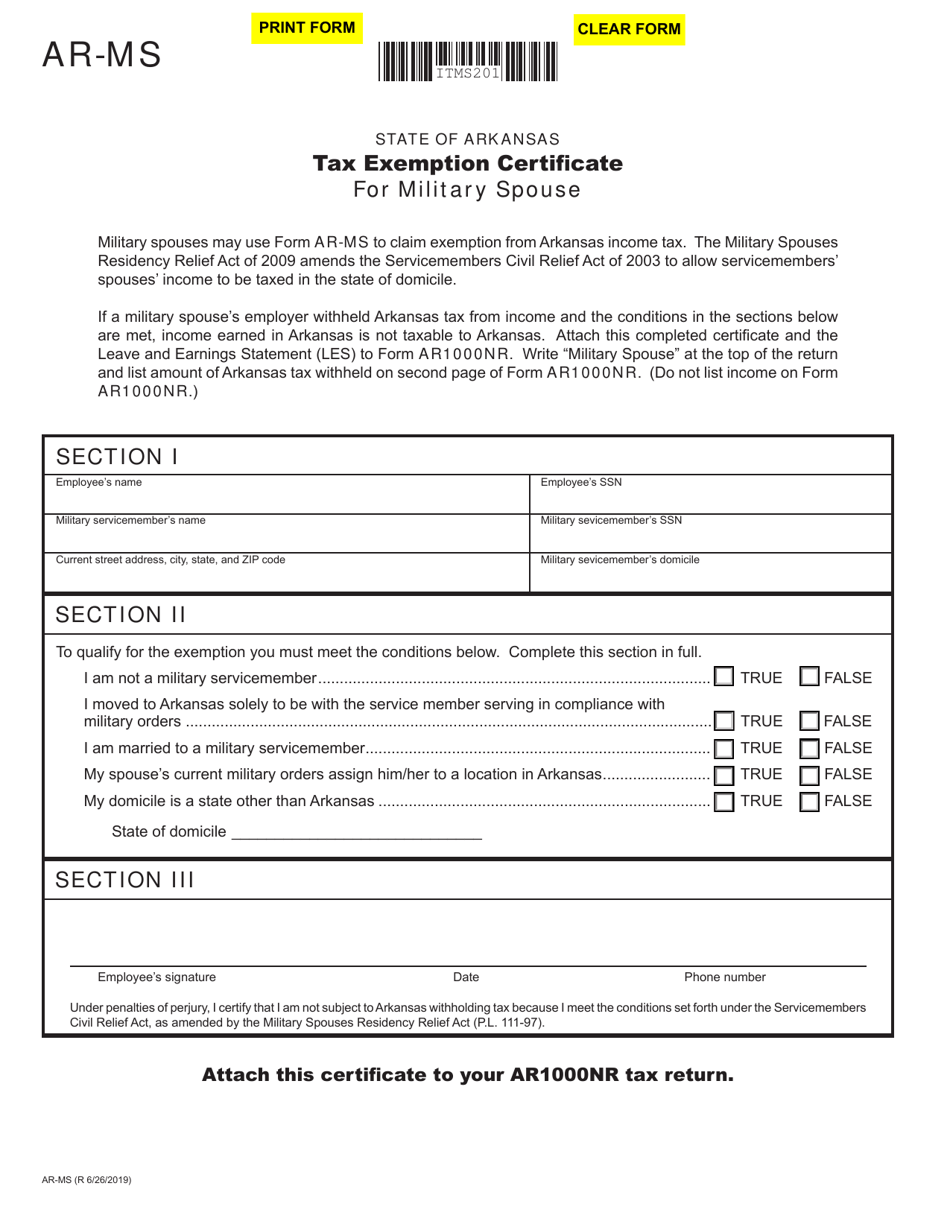

Military State Tax Exemption Form

The wages exempt from arkansas income tax will be the total of the amounts shown as exempt. Otherwise, your employer must withhold state income tax from. However, if the seller fraudulently fails to collect the sales tax, solicits a purchaser to participate. Provide the id number to claim exemption from sales tax that is required by the taxing state. File.

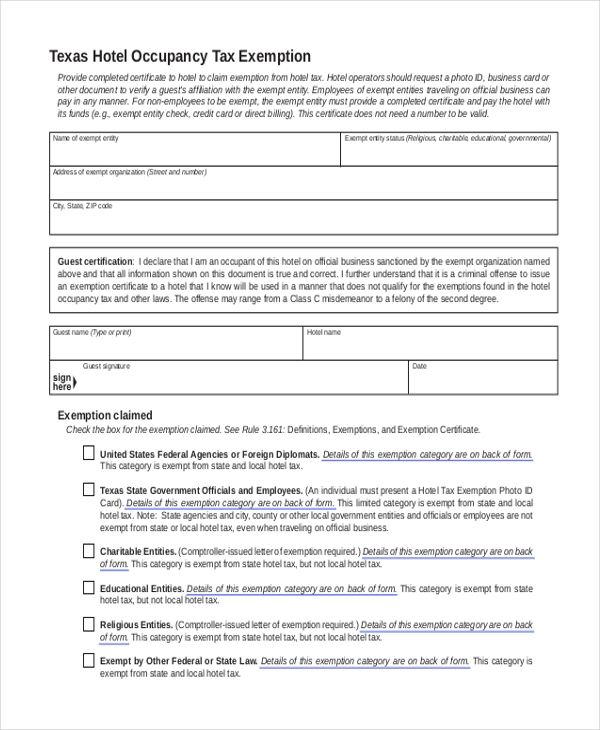

FREE 8 Sample Tax Exemption Forms In PDF MS Word

However, if the seller fraudulently fails to collect the sales tax, solicits a purchaser to participate. Otherwise, your employer must withhold state income tax from. The wages exempt from arkansas income tax will be the total of the amounts shown as exempt. Provide the id number to claim exemption from sales tax that is required by the taxing state. File.

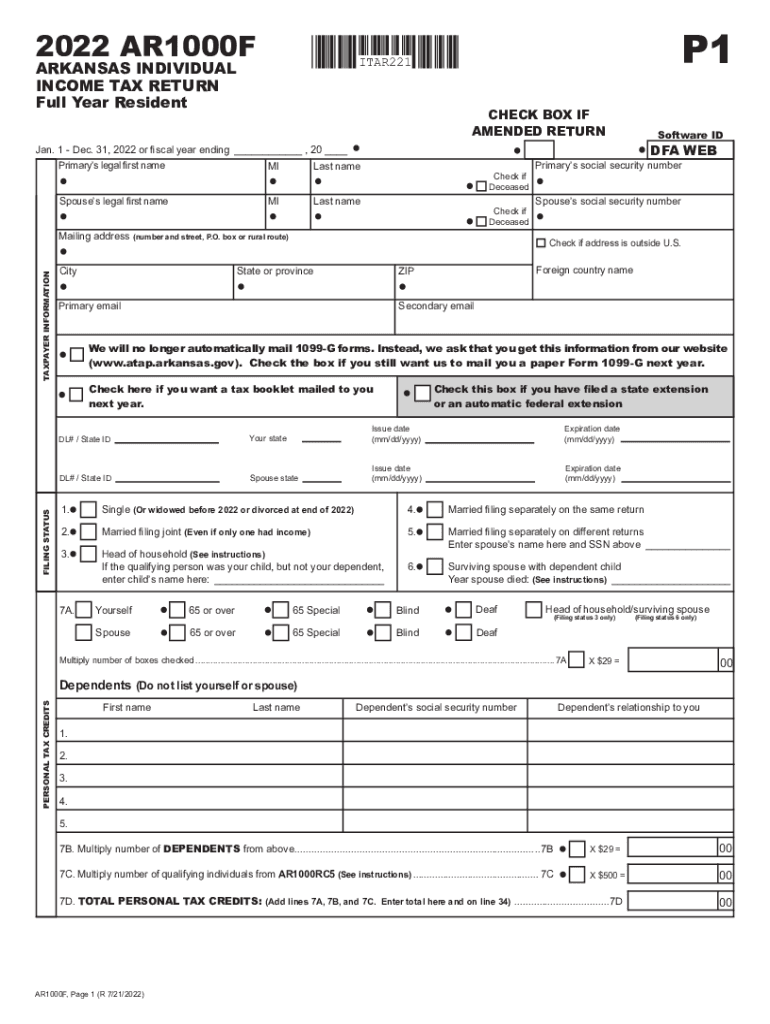

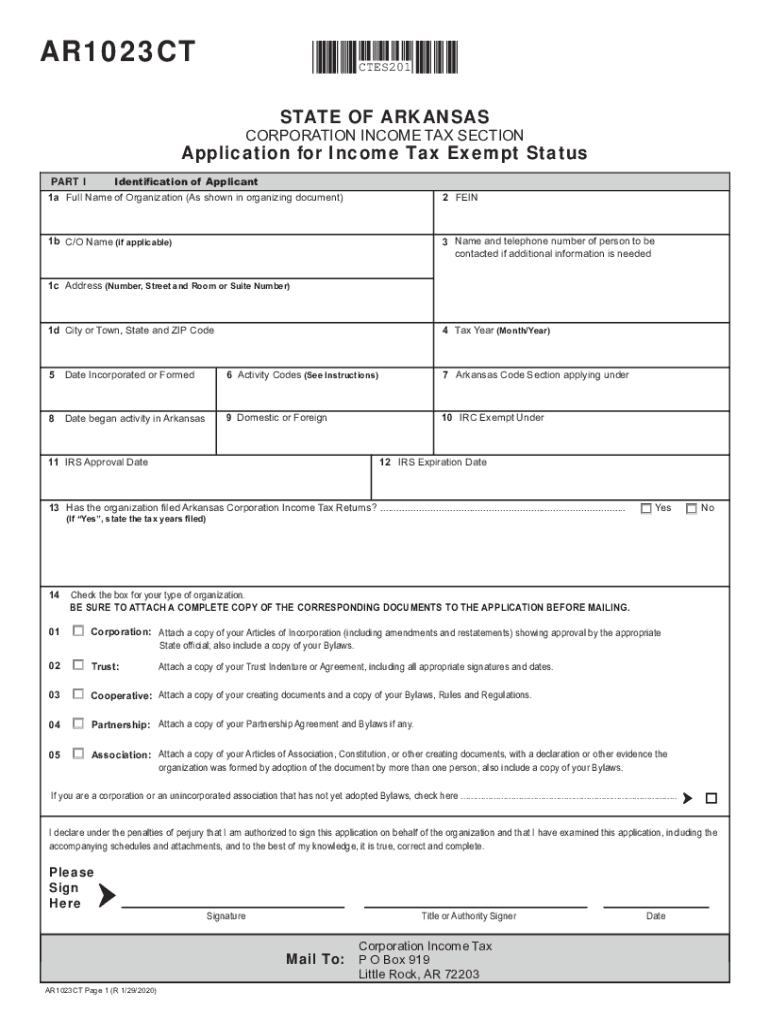

20222024 Form AR DFA AR1000F Fill Online, Printable, Fillable, Blank

However, if the seller fraudulently fails to collect the sales tax, solicits a purchaser to participate. Provide the id number to claim exemption from sales tax that is required by the taxing state. Otherwise, your employer must withhold state income tax from. The wages exempt from arkansas income tax will be the total of the amounts shown as exempt. File.

Arkansas Agriculture Sales Tax Exemption Form

However, if the seller fraudulently fails to collect the sales tax, solicits a purchaser to participate. The wages exempt from arkansas income tax will be the total of the amounts shown as exempt. Provide the id number to claim exemption from sales tax that is required by the taxing state. File this form with your employer. Otherwise, your employer must.

Arkansas State Tax Exemption Form

The wages exempt from arkansas income tax will be the total of the amounts shown as exempt. File this form with your employer. However, if the seller fraudulently fails to collect the sales tax, solicits a purchaser to participate. Otherwise, your employer must withhold state income tax from. Provide the id number to claim exemption from sales tax that is.

Arkansas State Tax Exemption Form

However, if the seller fraudulently fails to collect the sales tax, solicits a purchaser to participate. Provide the id number to claim exemption from sales tax that is required by the taxing state. Otherwise, your employer must withhold state income tax from. File this form with your employer. The wages exempt from arkansas income tax will be the total of.

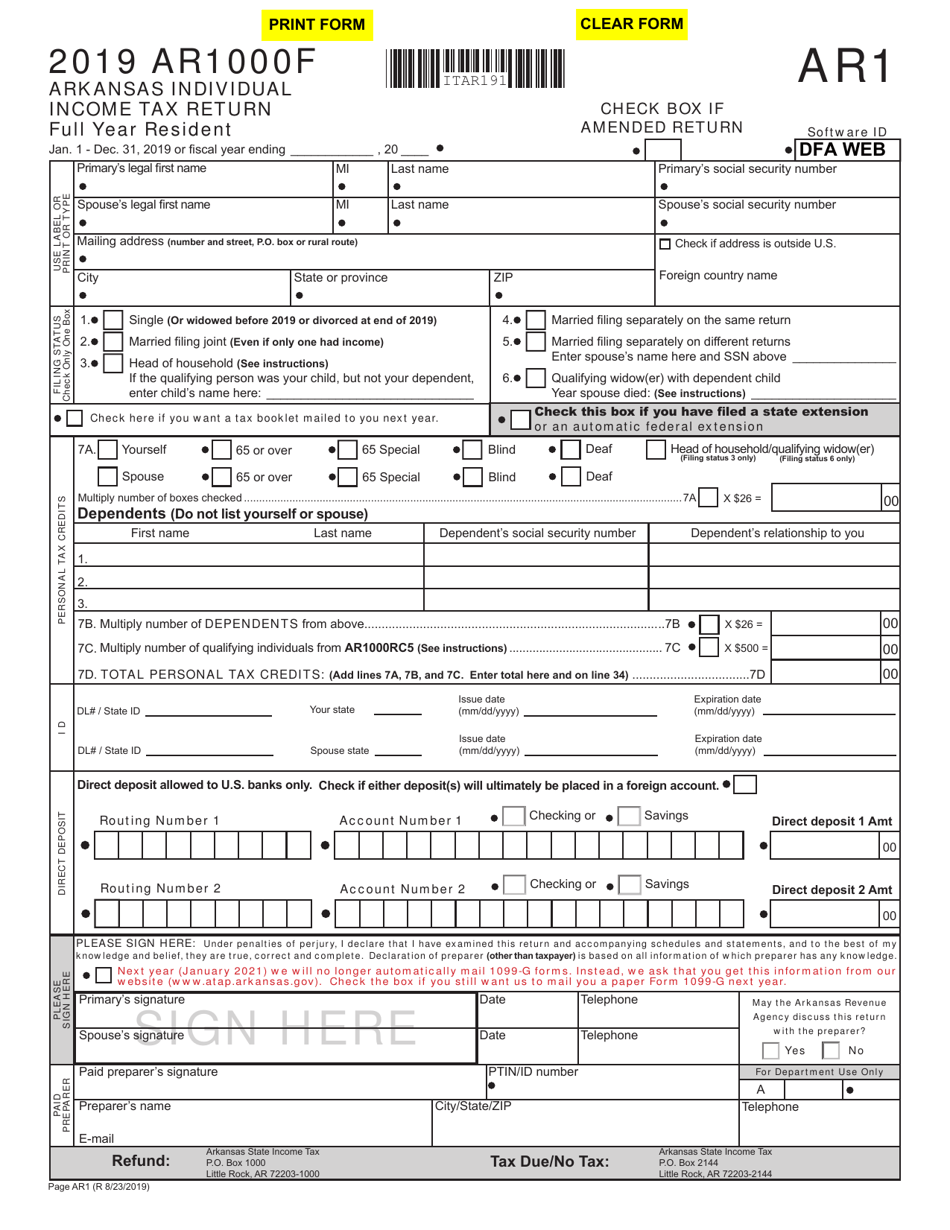

Arkansas Sales Tax Exemption Form

File this form with your employer. Otherwise, your employer must withhold state income tax from. Provide the id number to claim exemption from sales tax that is required by the taxing state. However, if the seller fraudulently fails to collect the sales tax, solicits a purchaser to participate. The wages exempt from arkansas income tax will be the total of.

Arkansas Tax Exempt Status Complete with ease airSlate SignNow

File this form with your employer. The wages exempt from arkansas income tax will be the total of the amounts shown as exempt. Otherwise, your employer must withhold state income tax from. Provide the id number to claim exemption from sales tax that is required by the taxing state. However, if the seller fraudulently fails to collect the sales tax,.

Fillable Form ArMs Tax Exemption Certificate For Military Spouse

The wages exempt from arkansas income tax will be the total of the amounts shown as exempt. However, if the seller fraudulently fails to collect the sales tax, solicits a purchaser to participate. Otherwise, your employer must withhold state income tax from. File this form with your employer. Provide the id number to claim exemption from sales tax that is.

Form ARMS Download Fillable PDF or Fill Online Tax Exemption

However, if the seller fraudulently fails to collect the sales tax, solicits a purchaser to participate. The wages exempt from arkansas income tax will be the total of the amounts shown as exempt. Otherwise, your employer must withhold state income tax from. Provide the id number to claim exemption from sales tax that is required by the taxing state. File.

Provide The Id Number To Claim Exemption From Sales Tax That Is Required By The Taxing State.

The wages exempt from arkansas income tax will be the total of the amounts shown as exempt. File this form with your employer. However, if the seller fraudulently fails to collect the sales tax, solicits a purchaser to participate. Otherwise, your employer must withhold state income tax from.