Cogs On Balance Sheet - Cogs is an important metric to track in improving profitability. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current. Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to the direct costs of goods. By understanding cogs, you can explore strategies, such as reducing.

By understanding cogs, you can explore strategies, such as reducing. Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to the direct costs of goods. Cogs is an important metric to track in improving profitability. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current.

Cogs is an important metric to track in improving profitability. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current. Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to the direct costs of goods. By understanding cogs, you can explore strategies, such as reducing.

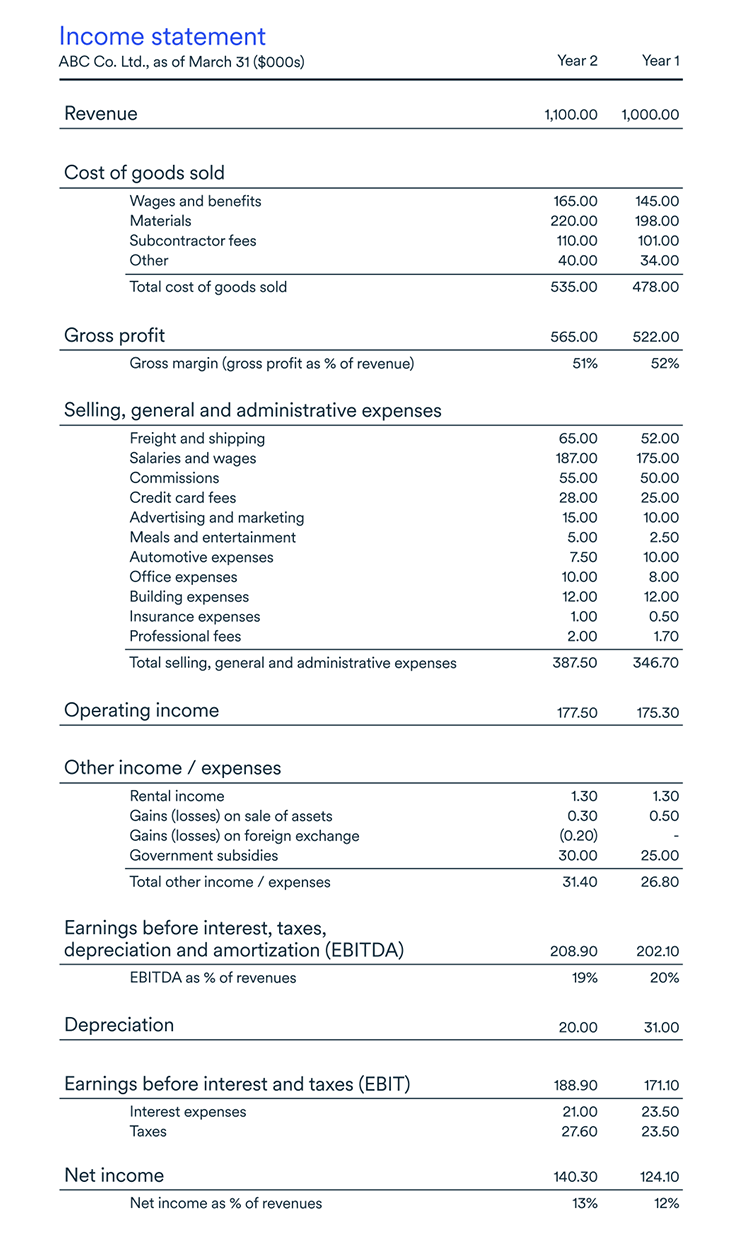

What is the cost of goods sold (COGS) BDC.ca

Cogs is an important metric to track in improving profitability. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current. By understanding cogs, you can explore strategies, such as reducing. Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to.

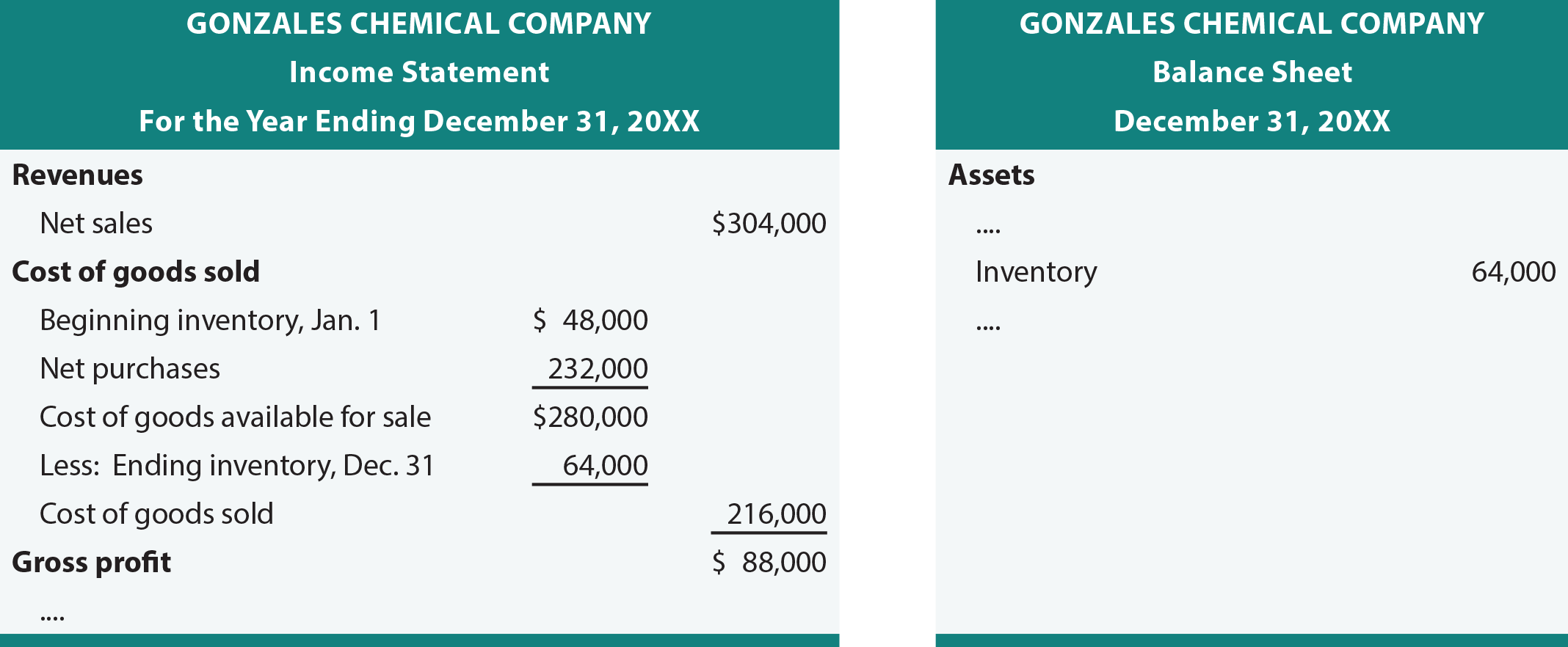

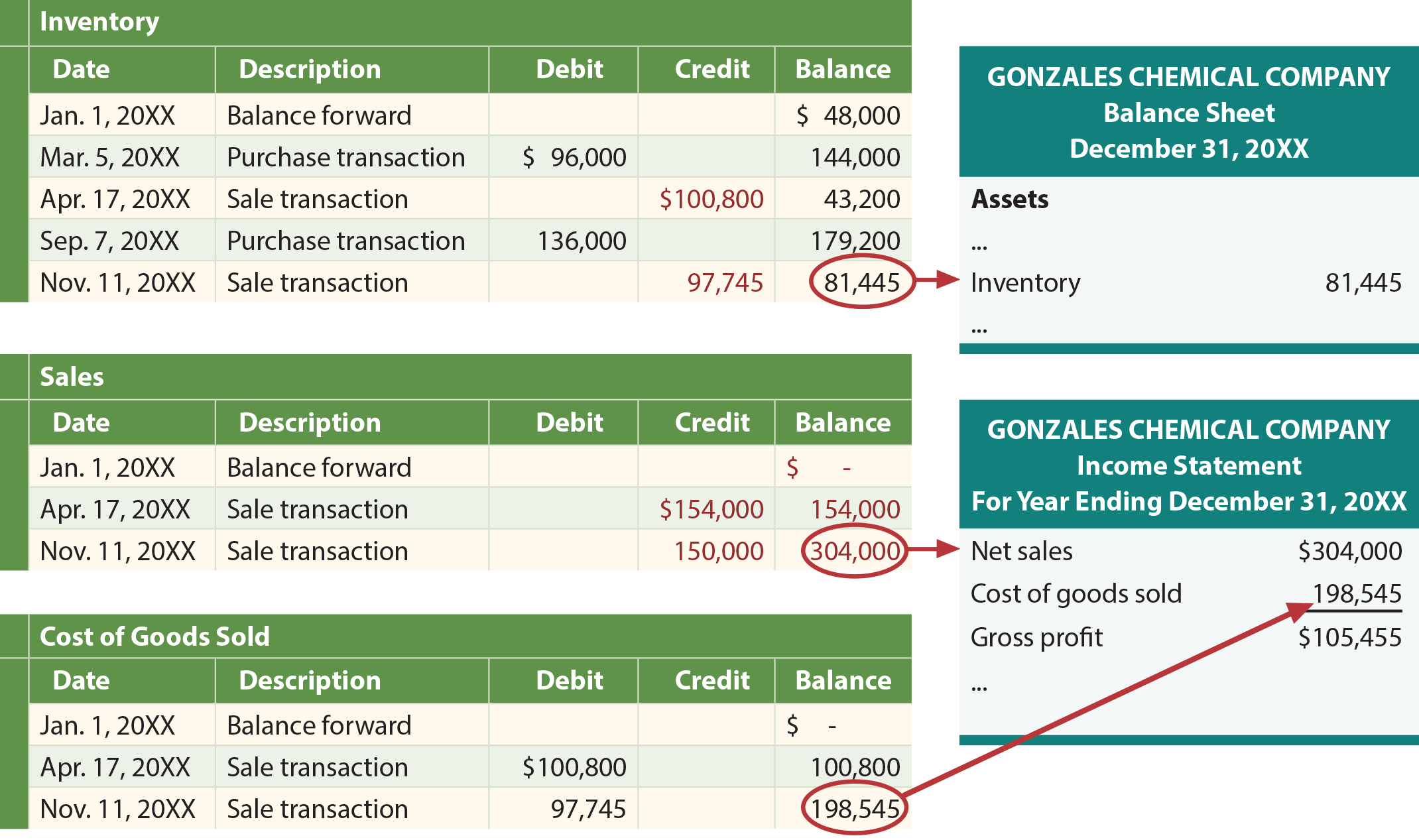

Solved Statement Balance Sheet Sales Cost of Goods

The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current. Cogs is an important metric to track in improving profitability. Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to the direct costs of goods. By understanding cogs, you can.

Inventory Costing Methods

Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to the direct costs of goods. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current. Cogs is an important metric to track in improving profitability. By understanding cogs, you can.

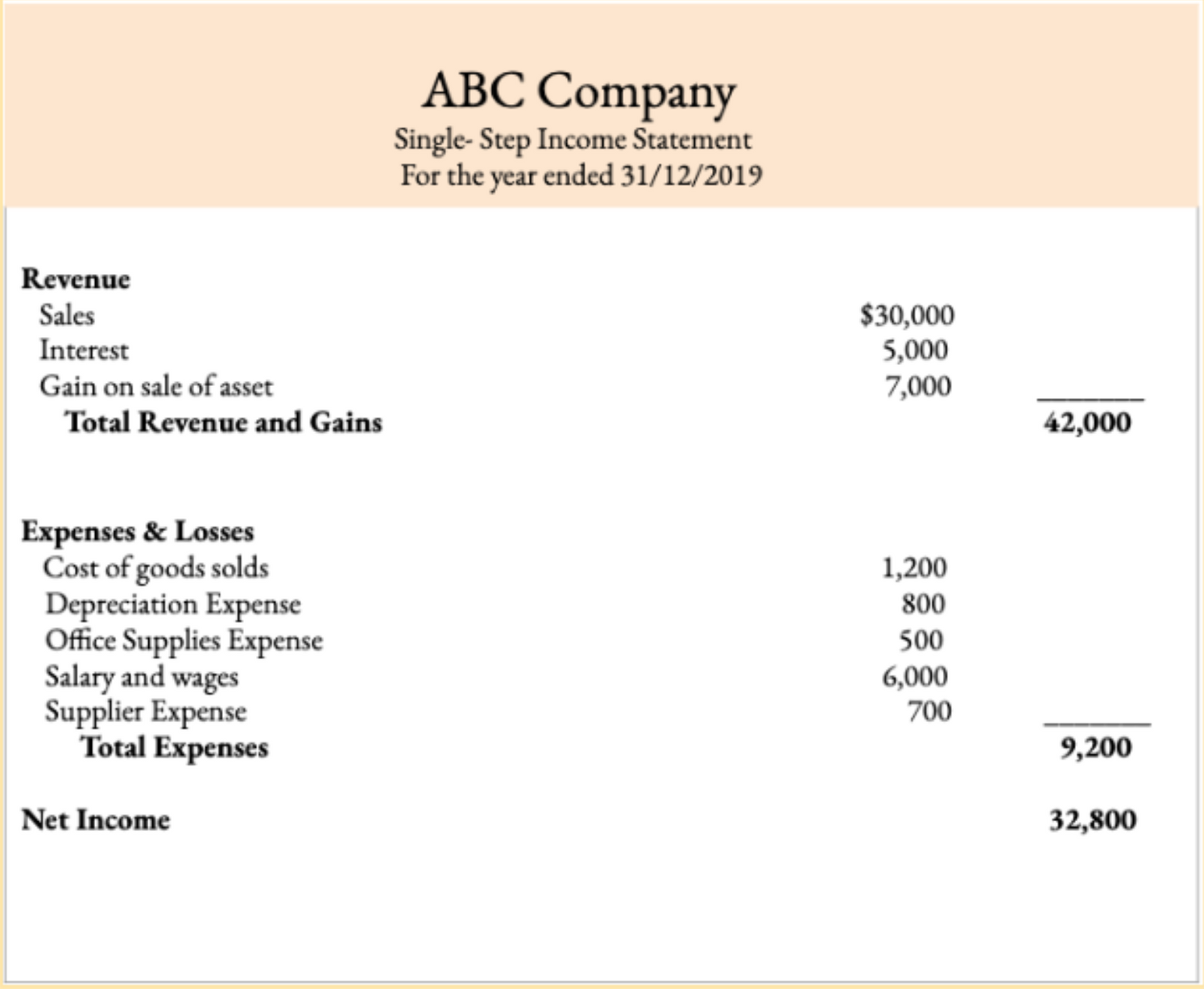

How To Calculate Cogs From Statement Haiper

The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current. Cogs is an important metric to track in improving profitability. By understanding cogs, you can explore strategies, such as reducing. Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to.

How to Account for Cost of Goods Sold (with Pictures) wikiHow

Cogs is an important metric to track in improving profitability. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current. Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to the direct costs of goods. By understanding cogs, you can.

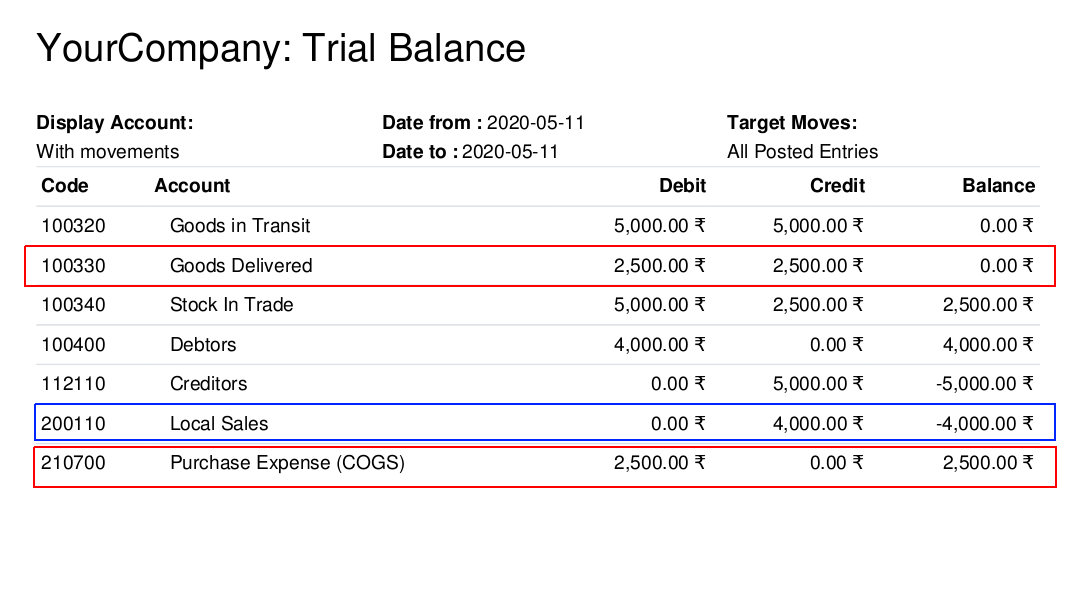

Cost of goods sold (COGS) using AngloSaxon Accounting BroadTech IT

Cogs is an important metric to track in improving profitability. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current. Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to the direct costs of goods. By understanding cogs, you can.

Calculate Cost of Goods Sold Learn How

The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current. By understanding cogs, you can explore strategies, such as reducing. Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to the direct costs of goods. Cogs is an important metric.

What Is Cost of Goods Sold (COGS)? Definition, Calculation, Examples

Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to the direct costs of goods. By understanding cogs, you can explore strategies, such as reducing. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current. Cogs is an important metric.

How to Calculate Budgeted Cost of Goods Sold Accounting Education

Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to the direct costs of goods. By understanding cogs, you can explore strategies, such as reducing. Cogs is an important metric to track in improving profitability. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance.

What does COGS mean on a balance sheet? Leia aqui What is COGS on a

The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current. Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to the direct costs of goods. By understanding cogs, you can explore strategies, such as reducing. Cogs is an important metric.

By Understanding Cogs, You Can Explore Strategies, Such As Reducing.

Cost of goods sold is also known as “cost of sales” or its acronym “cogs.” cogs refers to the direct costs of goods. Cogs is an important metric to track in improving profitability. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current.