Disclosure Of Fixed Deposit In Balance Sheet - The disclosure of deposits on fixed assets in financial statements is a transparent way to. Fixed deposit of 2,00,000 rupees deposited on 16/03/2016 was not shown in balance sheet as on 31/03/2016. Fixed deposits with maturity upto 12 months from date of balance sheet and rest as non current assets. Ind as schedule iii requires an entity to disclose names of the bodies corporate that are (i) subsidiaries, (ii) associates, (iii) joint ventures. Let us learn about the disclosure of assets and liabilities as per schedule vi. Share capital is disclosed in the following form:. Tds receivable is amount deducted by bank as per income tax rules under section 194, and it is treated as asset in the books. It sets out the minimum requirements for disclosure on the face of the financial statements, i.e., balance sheet,. Disclosure of fixed asset deposits. Learn how to report fixed deposits of varying maturities and categories in ind as financial statements with this detailed guide.

Fixed deposit of 2,00,000 rupees deposited on 16/03/2016 was not shown in balance sheet as on 31/03/2016. Ind as schedule iii requires an entity to disclose names of the bodies corporate that are (i) subsidiaries, (ii) associates, (iii) joint ventures. The disclosure of deposits on fixed assets in financial statements is a transparent way to. Learn how to report fixed deposits of varying maturities and categories in ind as financial statements with this detailed guide. Tds receivable is amount deducted by bank as per income tax rules under section 194, and it is treated as asset in the books. Fixed deposits with maturity upto 12 months from date of balance sheet and rest as non current assets. Disclosure of fixed asset deposits. Share capital is disclosed in the following form:. It sets out the minimum requirements for disclosure on the face of the financial statements, i.e., balance sheet,. Let us learn about the disclosure of assets and liabilities as per schedule vi.

Let us learn about the disclosure of assets and liabilities as per schedule vi. Learn how to report fixed deposits of varying maturities and categories in ind as financial statements with this detailed guide. Ind as schedule iii requires an entity to disclose names of the bodies corporate that are (i) subsidiaries, (ii) associates, (iii) joint ventures. Fixed deposit of 2,00,000 rupees deposited on 16/03/2016 was not shown in balance sheet as on 31/03/2016. Tds receivable is amount deducted by bank as per income tax rules under section 194, and it is treated as asset in the books. Fixed deposits with maturity upto 12 months from date of balance sheet and rest as non current assets. The disclosure of deposits on fixed assets in financial statements is a transparent way to. Disclosure of fixed asset deposits. Share capital is disclosed in the following form:. It sets out the minimum requirements for disclosure on the face of the financial statements, i.e., balance sheet,.

Silicon Valley Bank's balance sheet Why customer deposit withdrawals

Ind as schedule iii requires an entity to disclose names of the bodies corporate that are (i) subsidiaries, (ii) associates, (iii) joint ventures. The disclosure of deposits on fixed assets in financial statements is a transparent way to. Fixed deposits with maturity upto 12 months from date of balance sheet and rest as non current assets. Share capital is disclosed.

Us Gaap Balance Sheet Format Deferred Tax Disclosure Example Balance

Let us learn about the disclosure of assets and liabilities as per schedule vi. The disclosure of deposits on fixed assets in financial statements is a transparent way to. It sets out the minimum requirements for disclosure on the face of the financial statements, i.e., balance sheet,. Disclosure of fixed asset deposits. Ind as schedule iii requires an entity to.

Fabulous Certificate Of Deposit On Balance Sheet Unaudited Profit And

Fixed deposits with maturity upto 12 months from date of balance sheet and rest as non current assets. Let us learn about the disclosure of assets and liabilities as per schedule vi. Tds receivable is amount deducted by bank as per income tax rules under section 194, and it is treated as asset in the books. Learn how to report.

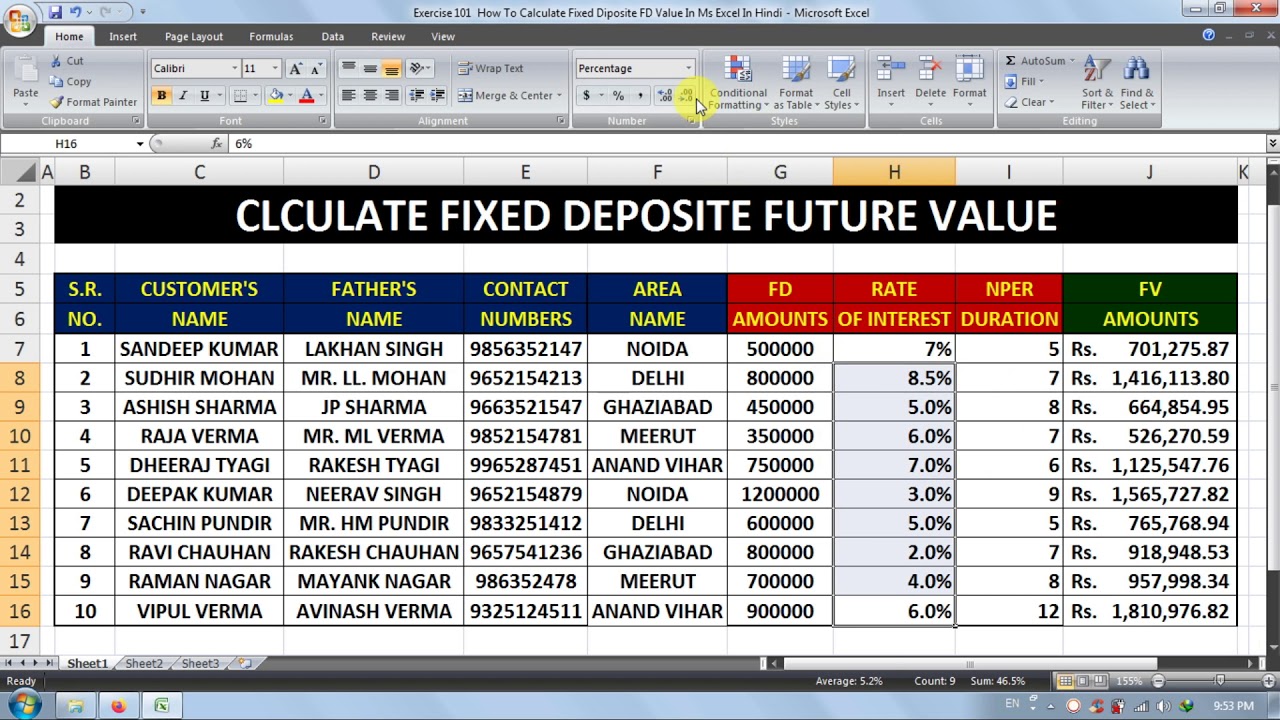

Fixed Deposit Excel Sheet Template Free Download

It sets out the minimum requirements for disclosure on the face of the financial statements, i.e., balance sheet,. Let us learn about the disclosure of assets and liabilities as per schedule vi. Ind as schedule iii requires an entity to disclose names of the bodies corporate that are (i) subsidiaries, (ii) associates, (iii) joint ventures. Fixed deposit of 2,00,000 rupees.

Fixed Deposit Excel Sheet Template Free Download Printable Calendars

Let us learn about the disclosure of assets and liabilities as per schedule vi. The disclosure of deposits on fixed assets in financial statements is a transparent way to. Share capital is disclosed in the following form:. Tds receivable is amount deducted by bank as per income tax rules under section 194, and it is treated as asset in the.

Fillable Online FixedDepositProductDisclosureSheet Baiduri

Fixed deposit of 2,00,000 rupees deposited on 16/03/2016 was not shown in balance sheet as on 31/03/2016. Learn how to report fixed deposits of varying maturities and categories in ind as financial statements with this detailed guide. Tds receivable is amount deducted by bank as per income tax rules under section 194, and it is treated as asset in the.

Financial Statement Bank Deposit Cash Balance Sheet Excel Template And

Tds receivable is amount deducted by bank as per income tax rules under section 194, and it is treated as asset in the books. Fixed deposit of 2,00,000 rupees deposited on 16/03/2016 was not shown in balance sheet as on 31/03/2016. Fixed deposits with maturity upto 12 months from date of balance sheet and rest as non current assets. The.

Best Time Deposit Classification In Balance Sheet Consolidated Accounts

Share capital is disclosed in the following form:. Fixed deposit of 2,00,000 rupees deposited on 16/03/2016 was not shown in balance sheet as on 31/03/2016. It sets out the minimum requirements for disclosure on the face of the financial statements, i.e., balance sheet,. Disclosure of fixed asset deposits. Learn how to report fixed deposits of varying maturities and categories in.

[Solved] The balance sheet and disclosure of signi SolutionInn

Fixed deposit of 2,00,000 rupees deposited on 16/03/2016 was not shown in balance sheet as on 31/03/2016. Learn how to report fixed deposits of varying maturities and categories in ind as financial statements with this detailed guide. Disclosure of fixed asset deposits. Share capital is disclosed in the following form:. The disclosure of deposits on fixed assets in financial statements.

Fixed Deposit Product Disclosure English PDF Interest Interest Rates

Fixed deposits with maturity upto 12 months from date of balance sheet and rest as non current assets. Fixed deposit of 2,00,000 rupees deposited on 16/03/2016 was not shown in balance sheet as on 31/03/2016. Disclosure of fixed asset deposits. Learn how to report fixed deposits of varying maturities and categories in ind as financial statements with this detailed guide..

The Disclosure Of Deposits On Fixed Assets In Financial Statements Is A Transparent Way To.

Learn how to report fixed deposits of varying maturities and categories in ind as financial statements with this detailed guide. Share capital is disclosed in the following form:. It sets out the minimum requirements for disclosure on the face of the financial statements, i.e., balance sheet,. Let us learn about the disclosure of assets and liabilities as per schedule vi.

Fixed Deposit Of 2,00,000 Rupees Deposited On 16/03/2016 Was Not Shown In Balance Sheet As On 31/03/2016.

Tds receivable is amount deducted by bank as per income tax rules under section 194, and it is treated as asset in the books. Disclosure of fixed asset deposits. Ind as schedule iii requires an entity to disclose names of the bodies corporate that are (i) subsidiaries, (ii) associates, (iii) joint ventures. Fixed deposits with maturity upto 12 months from date of balance sheet and rest as non current assets.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

![[Solved] The balance sheet and disclosure of signi SolutionInn](https://s3.amazonaws.com/si.question.images/image/images14/1265-B-C-A-C-B-A-M(2303).png)