How To Read A Balance Sheet Of A Company - It's important to know how to read a balance sheet to understand what a company owns and owes at a single point in time. A balance sheet provides a summary of a business at a given point in time. This page explains a balance sheet, why it’s essential, and how to read and create one. It shows what your business owns (assets), what it owes (liabilities), and how much has been invested by the owners (equity) at a specific point in time. The balance sheet is split into three sections: It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity. The balance sheet, also known as the statement of financial position, is one of the three key financial statements. Balance sheets serve two very different. How to read a balance sheet? The balance sheet is a key financial statement that provides a snapshot of a company's finances.

Reading a balance sheet is important in determining the financial health of a company. It shows what your business owns (assets), what it owes (liabilities), and how much has been invested by the owners (equity) at a specific point in time. This page explains a balance sheet, why it’s essential, and how to read and create one. It's important to know how to read a balance sheet to understand what a company owns and owes at a single point in time. The balance sheet, also known as the statement of financial position, is one of the three key financial statements. The balance sheet is a key financial statement that provides a snapshot of a company's finances. The balance sheet is split into three sections: It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity. A balance sheet provides a summary of a business at a given point in time. How to read a balance sheet?

The balance sheet, also known as the statement of financial position, is one of the three key financial statements. It shows what your business owns (assets), what it owes (liabilities), and how much has been invested by the owners (equity) at a specific point in time. A balance sheet provides a summary of a business at a given point in time. This page explains a balance sheet, why it’s essential, and how to read and create one. The balance sheet is split into three sections: Balance sheets serve two very different. How to read a balance sheet? The balance sheet is a key financial statement that provides a snapshot of a company's finances. It's important to know how to read a balance sheet to understand what a company owns and owes at a single point in time. It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity.

How to read and understand financial statements

It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity. Balance sheets serve two very different. Reading a balance sheet is important in determining the financial health of a company. It shows what your business owns (assets), what it owes (liabilities), and how much has been invested by the owners (equity) at a specific.

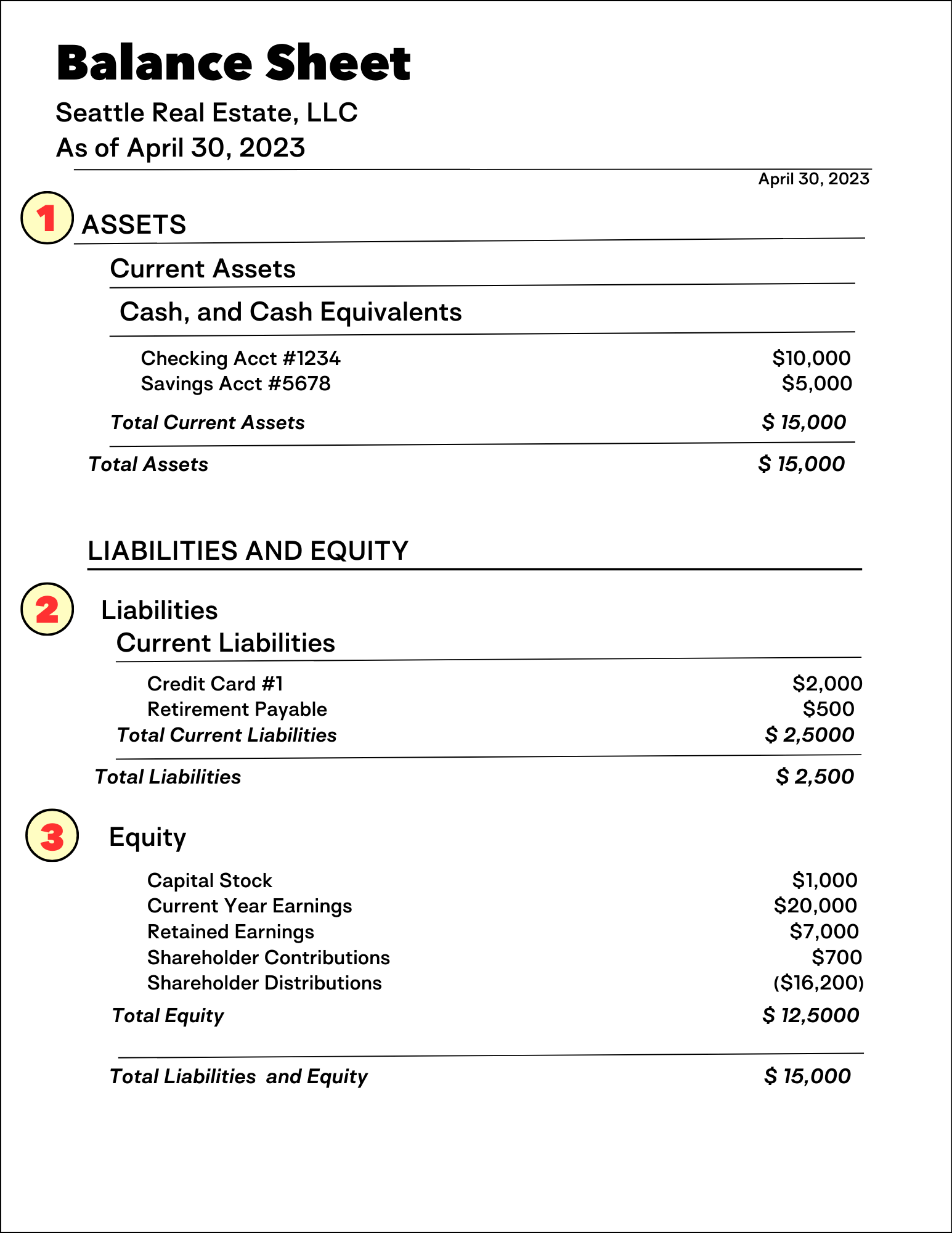

How read your balance sheet and actions to take

The balance sheet, also known as the statement of financial position, is one of the three key financial statements. The balance sheet is a key financial statement that provides a snapshot of a company's finances. How to read a balance sheet? Balance sheets serve two very different. It’s a snapshot of a company’s financial position, as broken down into assets,.

How To Read And Understand A Balance Sheet Business Explained Lights

Reading a balance sheet is important in determining the financial health of a company. This page explains a balance sheet, why it’s essential, and how to read and create one. The balance sheet is a key financial statement that provides a snapshot of a company's finances. The balance sheet, also known as the statement of financial position, is one of.

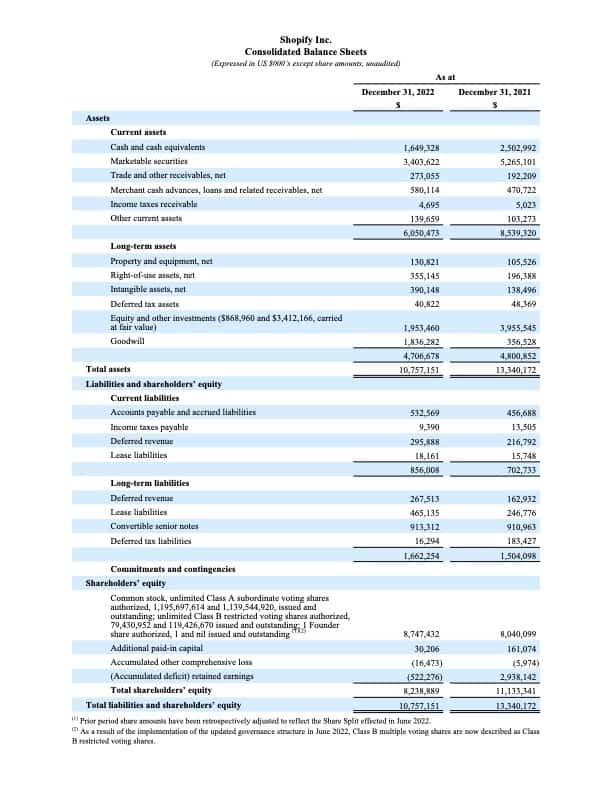

How to read Financial Statements of a Company? Trade Brains

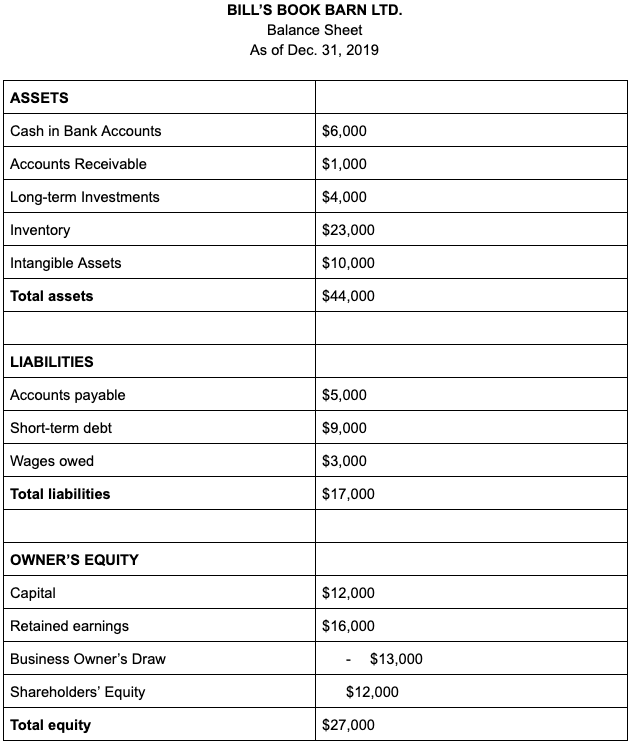

Reading a balance sheet is important in determining the financial health of a company. A balance sheet provides a summary of a business at a given point in time. Balance sheets serve two very different. It's important to know how to read a balance sheet to understand what a company owns and owes at a single point in time. The.

How to Read & Understand a Balance Sheet HBS Online

How to read a balance sheet? A balance sheet provides a summary of a business at a given point in time. The balance sheet is split into three sections: The balance sheet is a key financial statement that provides a snapshot of a company's finances. Reading a balance sheet is important in determining the financial health of a company.

How to Read a Balance Sheet The Motley Fool Canada

The balance sheet is a key financial statement that provides a snapshot of a company's finances. It shows what your business owns (assets), what it owes (liabilities), and how much has been invested by the owners (equity) at a specific point in time. It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity. How.

How to Read a Balance Sheet Bench Accounting

This page explains a balance sheet, why it’s essential, and how to read and create one. It shows what your business owns (assets), what it owes (liabilities), and how much has been invested by the owners (equity) at a specific point in time. How to read a balance sheet? It’s a snapshot of a company’s financial position, as broken down.

How to Read a Balance Sheet

It's important to know how to read a balance sheet to understand what a company owns and owes at a single point in time. Balance sheets serve two very different. Reading a balance sheet is important in determining the financial health of a company. It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity..

How to Read a Balance Sheet?

The balance sheet is a key financial statement that provides a snapshot of a company's finances. This page explains a balance sheet, why it’s essential, and how to read and create one. The balance sheet is split into three sections: It shows what your business owns (assets), what it owes (liabilities), and how much has been invested by the owners.

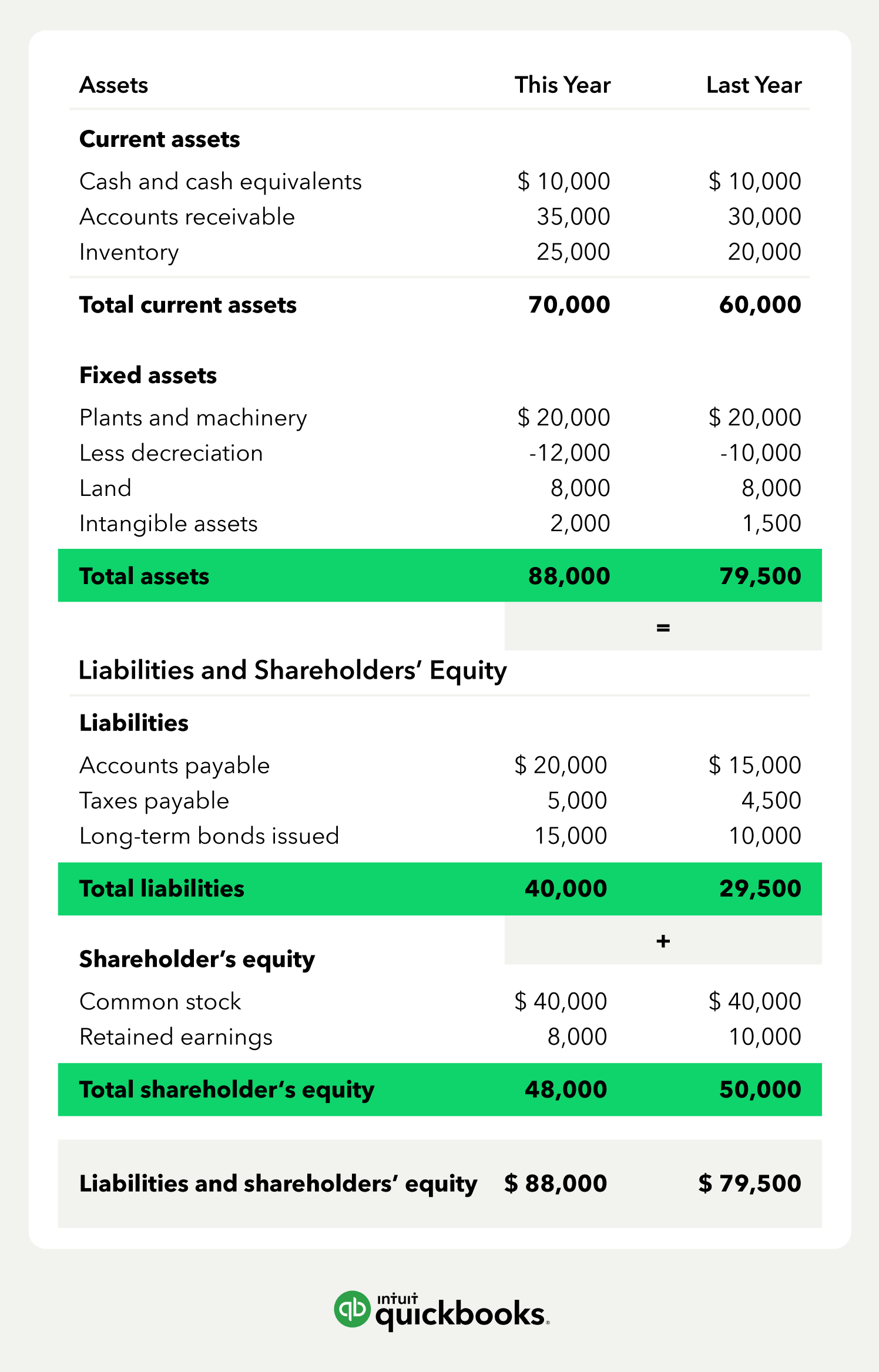

How to Read & Prepare a Balance Sheet QuickBooks

Reading a balance sheet is important in determining the financial health of a company. It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity. It shows what your business owns (assets), what it owes (liabilities), and how much has been invested by the owners (equity) at a specific point in time. This page explains.

It's Important To Know How To Read A Balance Sheet To Understand What A Company Owns And Owes At A Single Point In Time.

How to read a balance sheet? This page explains a balance sheet, why it’s essential, and how to read and create one. The balance sheet, also known as the statement of financial position, is one of the three key financial statements. Balance sheets serve two very different.

The Balance Sheet Is A Key Financial Statement That Provides A Snapshot Of A Company's Finances.

It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity. Reading a balance sheet is important in determining the financial health of a company. A balance sheet provides a summary of a business at a given point in time. The balance sheet is split into three sections: