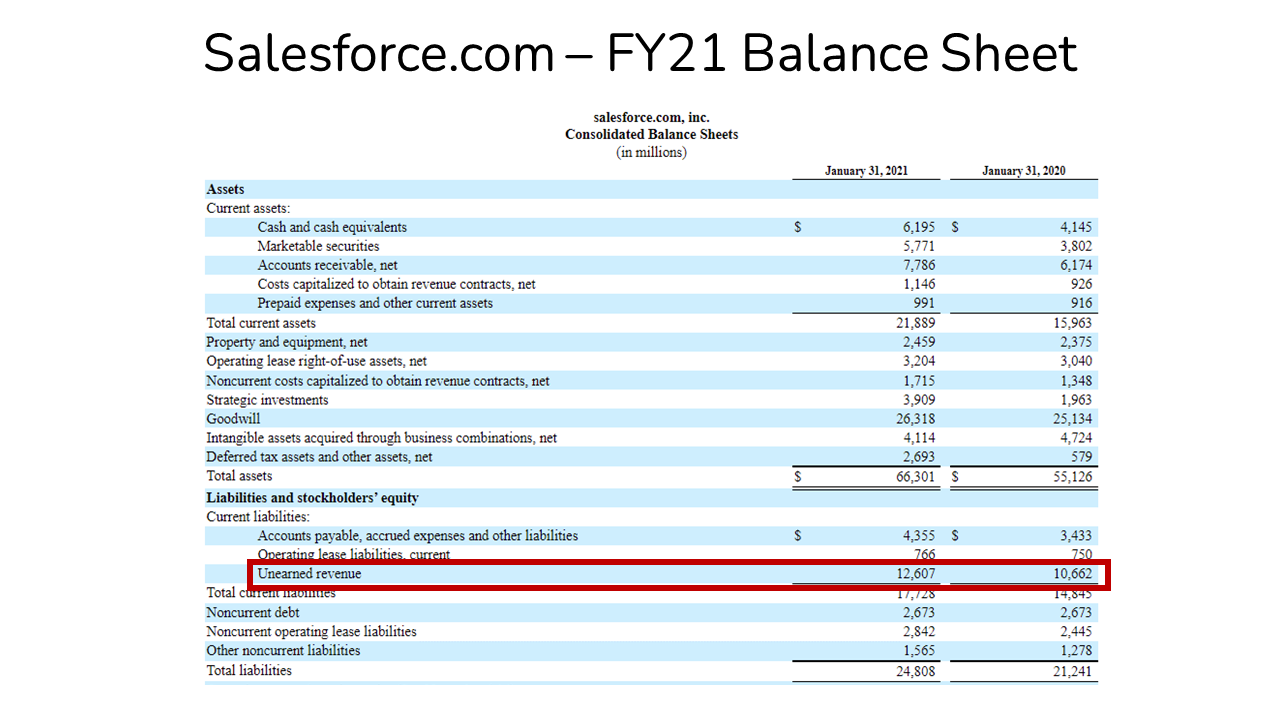

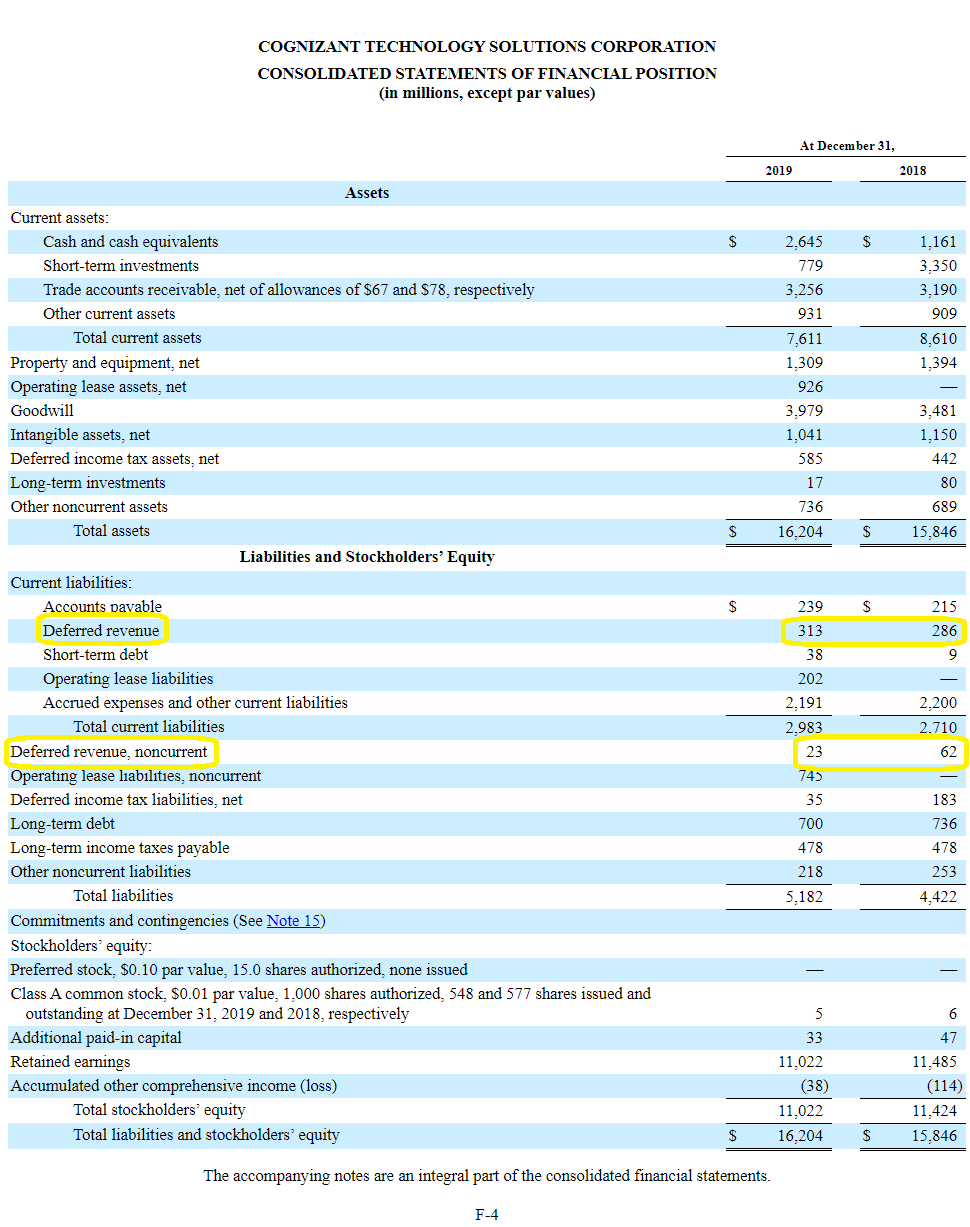

Is Deferred Revenue On The Balance Sheet - Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. It represents payments received for. Deferred revenue is a concept in accounting that affects how companies recognize income. It can be classified as a long. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. The deferred revenue account is normally classified as a current liability on the balance sheet. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or.

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. It represents payments received for. Deferred revenue is a concept in accounting that affects how companies recognize income. It can be classified as a long. The deferred revenue account is normally classified as a current liability on the balance sheet. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or.

Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. It can be classified as a long. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or. The deferred revenue account is normally classified as a current liability on the balance sheet. Deferred revenue is a concept in accounting that affects how companies recognize income. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. It represents payments received for.

What is Deferred Revenue? The Ultimate Guide (2022)

Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. The deferred revenue account is normally classified as a current liability on the balance sheet. It can be classified as a long. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver.

Deferred Revenue AwesomeFinTech Blog

Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. Deferred revenue is a concept in accounting that affects how companies recognize income. It represents payments received for. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or. It can.

What Is Unearned Revenue? QuickBooks Global

Deferred revenue is a concept in accounting that affects how companies recognize income. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. The deferred revenue account is normally classified as a current liability on the balance sheet. Deferred revenue appears as a liability on the balance sheet.

What Is Deferred Revenue? Complete Guide Pareto Labs

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or. It can be classified as a long. The deferred revenue account is normally classified as a current.

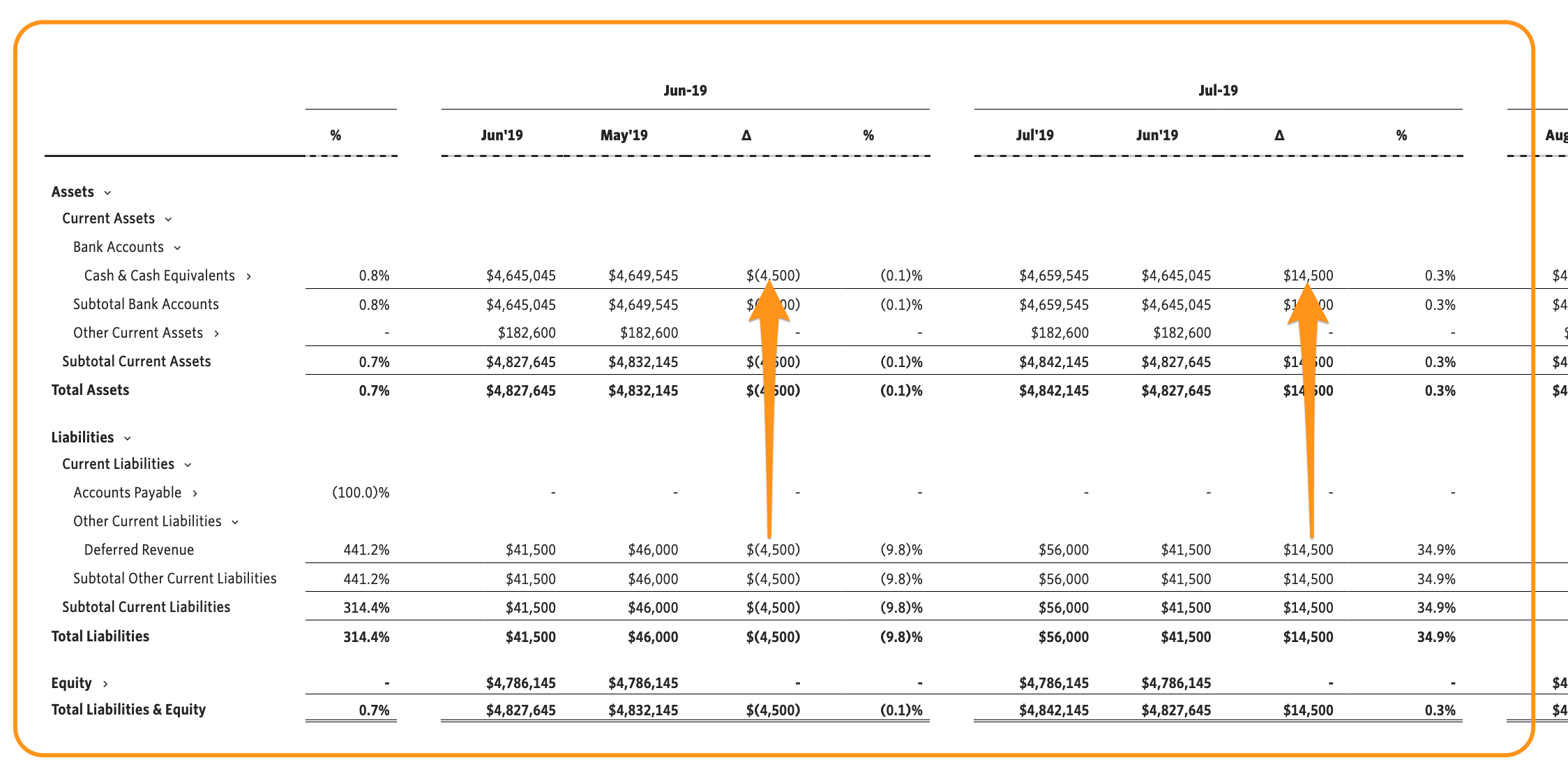

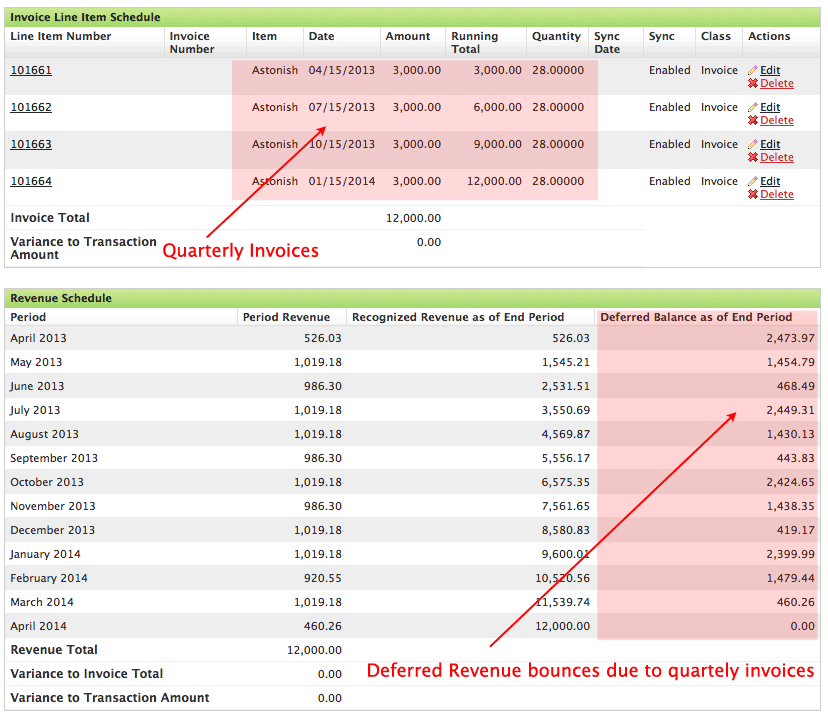

Simple Deferred Revenue with Jirav Pro

Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. It represents payments received for. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. It can be classified as a long. Deferred revenue is a concept in accounting.

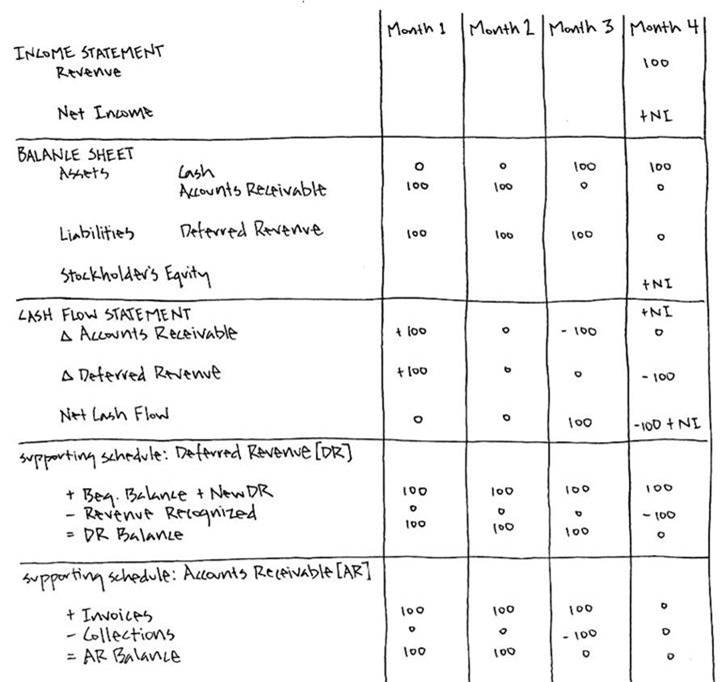

Deferred Revenue Debit or Credit and its Flow Through the Financials

It represents payments received for. Deferred revenue is a concept in accounting that affects how companies recognize income. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer.

Deferred Revenue A Simple Model

Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or. It represents payments received for. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. The deferred revenue account is normally classified as a current liability on.

Deferred Revenue Schedule Template

The deferred revenue account is normally classified as a current liability on the balance sheet. Deferred revenue is a concept in accounting that affects how companies recognize income. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. It can be classified as a long. Deferred revenue appears.

Deferred Revenue Balance Sheet Ppt Powerpoint Presentation Visual Aids

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. It represents payments received for. Deferred revenue is recorded on the balance sheet as a liability because it represents.

Deferred Revenue Accounting, Definition, Example

The deferred revenue account is normally classified as a current liability on the balance sheet. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or. It represents payments received for. Deferred revenue is a concept in accounting that affects how companies recognize income. Deferred revenue is recorded as a.

Deferred Revenue Appears As A Liability On The Balance Sheet Because It Represents An Obligation To Deliver Goods Or.

It can be classified as a long. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue is a concept in accounting that affects how companies recognize income. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or.

It Represents Payments Received For.

The deferred revenue account is normally classified as a current liability on the balance sheet.