Penalty For Not Filing Form 8938 - If you are required to file form 8938 but do not file a complete and. If you failed to file a form 8938, or filed one that was incorrect, incomplete, or. Learn about the repercussions of neglecting to file form 8938, including fines and. Failure to report foreign financial assets on form 8938 may result in a penalty of $10,000 (and a. No penalty will be imposed if you fail to file form 8938 or to disclose one or more specified. Yes, it is possible to get out of a form 8938 penalty for not reporting foreign financial. If you are required to file form 8938 but do not file a complete and.

Failure to report foreign financial assets on form 8938 may result in a penalty of $10,000 (and a. No penalty will be imposed if you fail to file form 8938 or to disclose one or more specified. Yes, it is possible to get out of a form 8938 penalty for not reporting foreign financial. If you are required to file form 8938 but do not file a complete and. If you failed to file a form 8938, or filed one that was incorrect, incomplete, or. Learn about the repercussions of neglecting to file form 8938, including fines and. If you are required to file form 8938 but do not file a complete and.

If you are required to file form 8938 but do not file a complete and. Yes, it is possible to get out of a form 8938 penalty for not reporting foreign financial. No penalty will be imposed if you fail to file form 8938 or to disclose one or more specified. If you are required to file form 8938 but do not file a complete and. Learn about the repercussions of neglecting to file form 8938, including fines and. If you failed to file a form 8938, or filed one that was incorrect, incomplete, or. Failure to report foreign financial assets on form 8938 may result in a penalty of $10,000 (and a.

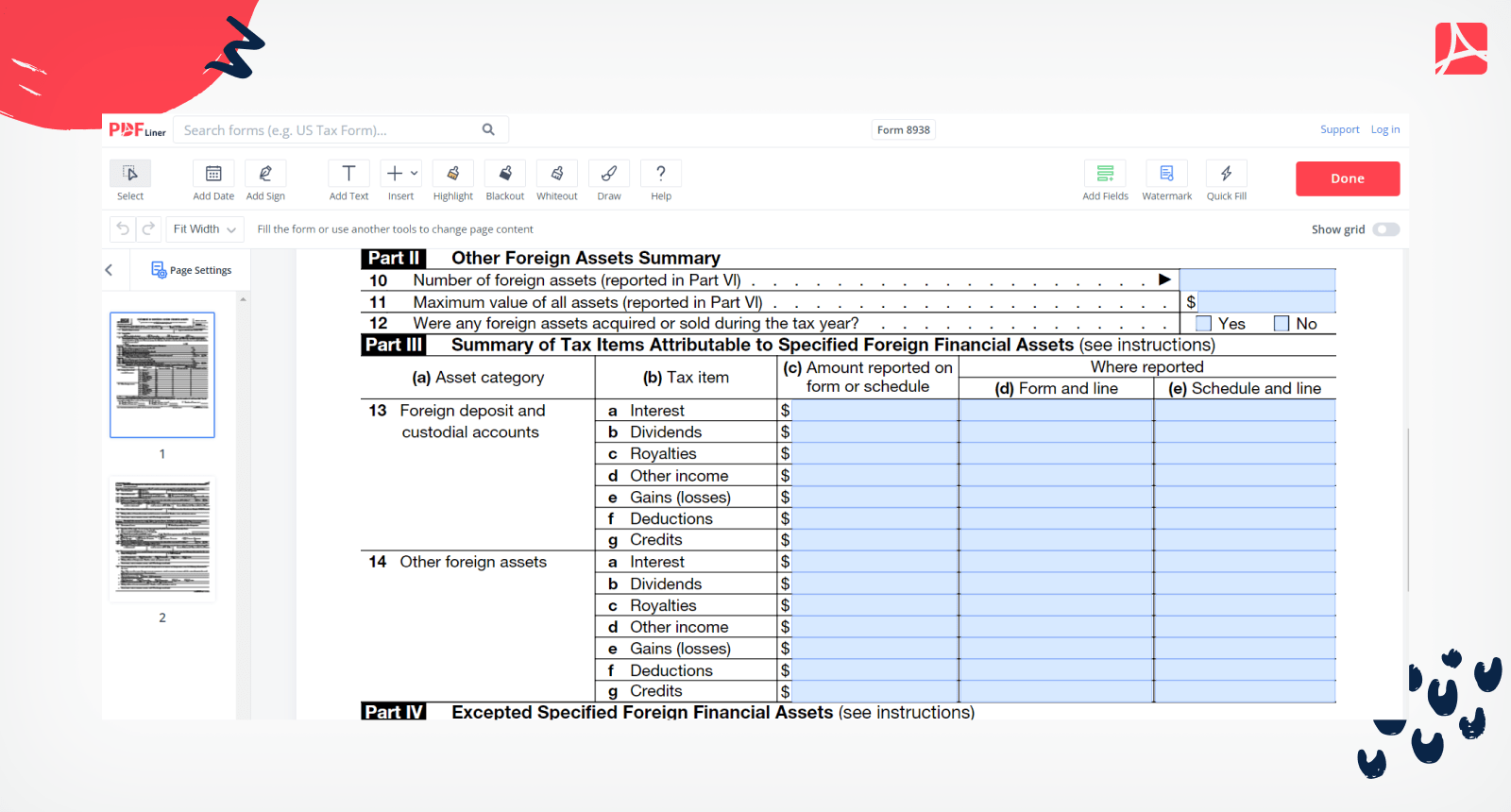

Form 8938 IRS Form 8938 Fillable and Printable blank PDFline

If you are required to file form 8938 but do not file a complete and. Learn about the repercussions of neglecting to file form 8938, including fines and. No penalty will be imposed if you fail to file form 8938 or to disclose one or more specified. If you failed to file a form 8938, or filed one that was.

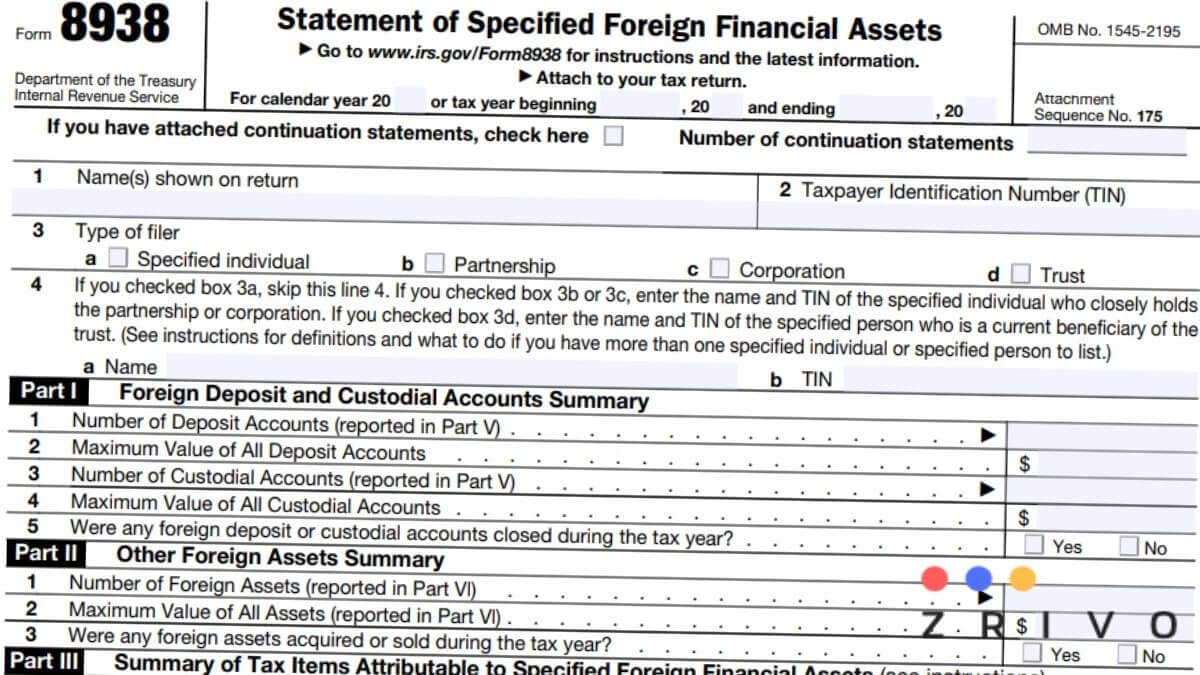

8938 Form 2021

No penalty will be imposed if you fail to file form 8938 or to disclose one or more specified. If you are required to file form 8938 but do not file a complete and. If you failed to file a form 8938, or filed one that was incorrect, incomplete, or. Failure to report foreign financial assets on form 8938 may.

Form 8938 Filing Thresholds FATCA Tax Lawyer and Attorney Update

Yes, it is possible to get out of a form 8938 penalty for not reporting foreign financial. If you are required to file form 8938 but do not file a complete and. Learn about the repercussions of neglecting to file form 8938, including fines and. No penalty will be imposed if you fail to file form 8938 or to disclose.

IRS Form 8938 Filing Requirements FBAR vs 8938 FATCA Threshhold

Failure to report foreign financial assets on form 8938 may result in a penalty of $10,000 (and a. Learn about the repercussions of neglecting to file form 8938, including fines and. If you are required to file form 8938 but do not file a complete and. No penalty will be imposed if you fail to file form 8938 or to.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

No penalty will be imposed if you fail to file form 8938 or to disclose one or more specified. Failure to report foreign financial assets on form 8938 may result in a penalty of $10,000 (and a. If you are required to file form 8938 but do not file a complete and. Yes, it is possible to get out of.

Form 8938 Filing Requirement Tax Strategies Motley Fool Community

If you are required to file form 8938 but do not file a complete and. If you are required to file form 8938 but do not file a complete and. Yes, it is possible to get out of a form 8938 penalty for not reporting foreign financial. No penalty will be imposed if you fail to file form 8938 or.

Form 8938 Blank Sample to Fill out Online in PDF

If you are required to file form 8938 but do not file a complete and. No penalty will be imposed if you fail to file form 8938 or to disclose one or more specified. Learn about the repercussions of neglecting to file form 8938, including fines and. Yes, it is possible to get out of a form 8938 penalty for.

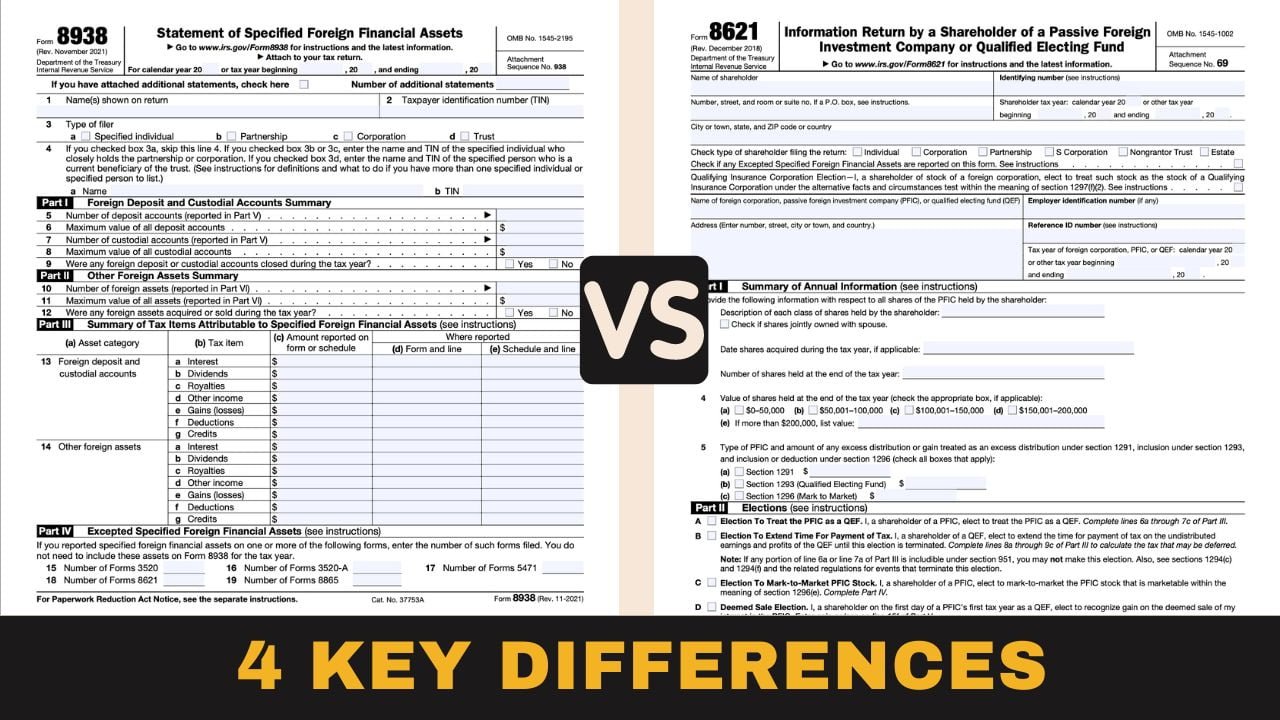

Form 8938 And Form 8621 Key Differences

Learn about the repercussions of neglecting to file form 8938, including fines and. If you are required to file form 8938 but do not file a complete and. Failure to report foreign financial assets on form 8938 may result in a penalty of $10,000 (and a. Yes, it is possible to get out of a form 8938 penalty for not.

Understanding Form 8938 Filing Thresholds

No penalty will be imposed if you fail to file form 8938 or to disclose one or more specified. Failure to report foreign financial assets on form 8938 may result in a penalty of $10,000 (and a. If you failed to file a form 8938, or filed one that was incorrect, incomplete, or. If you are required to file form.

Form 8938 Instructions Do You Need to Report? GlobalBanks

Yes, it is possible to get out of a form 8938 penalty for not reporting foreign financial. If you are required to file form 8938 but do not file a complete and. Learn about the repercussions of neglecting to file form 8938, including fines and. If you failed to file a form 8938, or filed one that was incorrect, incomplete,.

Yes, It Is Possible To Get Out Of A Form 8938 Penalty For Not Reporting Foreign Financial.

No penalty will be imposed if you fail to file form 8938 or to disclose one or more specified. If you are required to file form 8938 but do not file a complete and. If you are required to file form 8938 but do not file a complete and. If you failed to file a form 8938, or filed one that was incorrect, incomplete, or.

Failure To Report Foreign Financial Assets On Form 8938 May Result In A Penalty Of $10,000 (And A.

Learn about the repercussions of neglecting to file form 8938, including fines and.